Business

From M&A freezes to delayed procedures, how disruptive has 2020 been for med tech?

A drop in M&A values and an abrupt halt to ‘elective’ procedures have taken their toll on the med tech industry in 2020. However, it is not all doom and gloom. The signing of two megadeals in August, unprecedented acceleration in digital health services and a huge focus on fields like diagnostics suggest the industry is primed to bounce back in 2021. Allie Nawrat reports.

O

ver the past ten years, the med tech sector has consistently performed well and experienced growth. With 2019 seeing the continuation of this trend, many predicted that further growth for med tech would occur in 2020.

Any mergers and acquisitions (M&A) activity in January and February 2020 swiftly came to an end in March and April as the Covid-19 pandemic hit, bringing financial instability and uncertainty with it. Indeed, Ernst Young (EY)’s Pulse of the industry 2020 report on med tech found that the Covid-19 disruption was most evident in the industry’s M&A performance.

“There is no doubt that it’s slowed down the pace” of med tech M&As, notes EY life science partner John Babitt. EY’s report found that total M&A values fell by 60% from $67.6bn in 2019 to $27.1bn. The average deal value fell from $463m to $167m, according to EY’s figures. This decline was particularly evidence in the second half of the year. According to a report by Evaluate, the average size of completed mergers in the first six months of 2020 was lower than at any point in the past decade.

This situation was not helped by one of the three 2020 mega-deals – those worth over $10bn –falling through. In August, Thermo Fischer Scientific’s $11.5bn offer to acquire Qiagen was refused by the latter’s shareholders who argued the company was worth more.

Where has med tech been hit hardest?

Although general uncertainty and travel restrictions linked to the pandemic have affected all industries, the financial impact of Covid-19 on the med tech industry has been primarily linked to the significant consequence of companies focusing on so-called ‘elective’ procedures. This is emphasised in both EY’s report and PricewaterhouseCoopers (PwC)’s life sciences deals insights midyear 2020 analysis.

Babitt, who prefers the term deferrable to ‘elective’ procedures, notes that they were “draconically” impacted by the pandemic. This is because they are not emergency procedures and can therefore be delayed as more and more hospital beds needed to be reserved for Covid-19 patients. EY’s report also notes that patients were choosing to steer clear of hospitals for non-emergency procedures this year.

Patients were choosing to steer clear of hospitals for non-emergency procedures this year.

The report also found that eight companies primarily focused on ‘elective’ procedures saw their revenues fall by at least 15%. These include Envista, Dentsply Sirona and Zimmer Biomet.

As a result, many of these companies “which were going to do deals had no choice to put them on hold, look internally and solidify their own company to weather this storm”, adds PwC US pharma and life sciences leader Glenn Hunzinger.

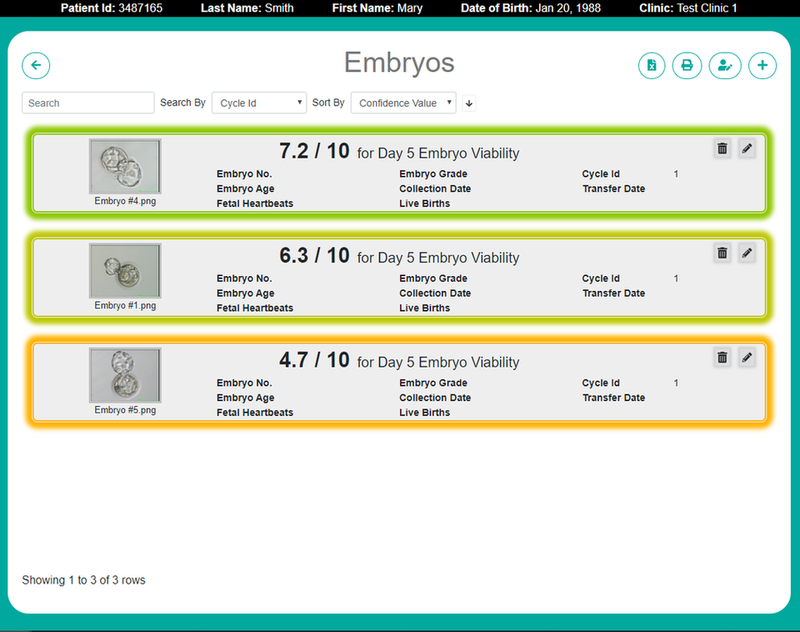

Life Whisperer rates the viability of embryos for transfer. Image: Life Whisperer

Not all doom and gloom

Although Covid-19 has had a negative impact on med tech deals and M&As, Lincoln International concludes that med tech is not closed for business. In fact, there are areas of the med tech industry that have flourished because companies have stepped up to help manage and mitigate the Covid-19 crisis.

“Medtech’s work has saved lives, allowed medical facilities to keep running, enabled patients to be treated in hospitals or at home and overall made it possible for normal operations to be maintained, while simultaneously also helping health systems, governments and the general public wage a global health battle on a scale not previously seen this century,” wrote EY global med tech leader Jim Welch in the report’s introduction.

Med tech’s work has saved lives and overall made it possible for normal operations to be maintained.

Although performing worse than pharma in terms of general deal values and volumes, according to PwC’s report, Babitt notes that med tech has outperformed pharma in terms of M&As.

Until Gilead’s announcement that it was acquiring Immunomedics for $21bn in September, the pharma field had largely been missing mega M&As. Babitt notes there had been a lot of partnering and initial public offerings, but not a lot of “true M&A”, as he terms it.

Spotlight on digital health and diagnostics

The largest med tech mega-deal of 2020 – Teladoc’s acquisition of Livongo for $18.5bn – is also the largest M&A investment ever made in digital health. “With the success of the Livongo-Teladoc deal… everyone is talking about how digital healthcare delivery has really accelerated [during the pandemic]. What might have been on a three-year trajectory has been truncated into about three months,” notes Babitt.

“It may be that the events of 2020 will conclusively demonstrate to medtech and the broader life sciences industry that digital acceleration is needed,” according to EY’s report. The pandemic has caused a rising demand for remote care technology for chronic diseases and general health management as people want to avoid excessive trips to the hospitals and doctors’ surgeries.

Everyone is talking about how digital healthcare delivery has really accelerated.

In addition, the third of the 2020 mega-deals – Siemens Healthineers' $16.4bn acquisition of Varian Medical – suggests that more traditional med tech companies are also interested in digital health. This acquisition differs to the first because Teladoc and Livongo are both existing players in the digital health field, which have expanded their offerings as a result of the deal.

Siemens Healthineers’ acquisition allows it to build its diagnostics and imaging portfolio and provide access to end-to-end oncology solutions from diagnostics to treatment under one vendor.

Diagnostics is another area that has grown this year. EY found that companies focused on diagnostics saw a rise in revenues due to heightened demand from the pandemic; as of August 2020, 448 Covid-19 related diagnostics were launched or in development. In addition, non-imaging diagnostics was found by EY to be the forefront of the M&A space in 2020.

Med tech’s bright future

After a slow first half, EY sees the announcement of the two remaining mega-deals – Teladoc-Livongo and Siemens Healthineers-Varian – in August as a possible reversal in the general downward M&A trend. “This raises the prospect that the industry may now be ready to deploy some of its debt-financed firepower in more aggressive M&A deals,” concluded EY.

Babitt also noted that on earnings calls companies have been expressing their eagerness to start M&A once again. Companies have found a way to adapt to get deals done despite the travel restrictions.

The industry may now be ready to deploy some of its debt-financed firepower in more aggressive M&A deals.

He is optimistic about 2021 because “there are going to be a new crop of business that have been successful during this timeframe” – including those in the digital health space – and their capabilities match well with larger, traditional med tech companies. “We’ve got new opportunities to really double down and turbocharge business… [so] I think we could see some nice activity into 2021,” he says.

Hunzinger also believes there will be large deals and consolidation in 2021. He talks about how important scale remains to the med tech industry, and how this intersects with the wave of innovation in the sector, particularly around technology, that has emerged in 2020 and what that means for the future of health.

Lincoln International argues that medical technology will be able to bounce back more rapidly to pre-Covid-19 levels, compared to other industries. Med tech is in a good position as 2021 approaches because of its commitments during the Covid-19 pandemic; EY’s report noted that this has raised the industry’s profile and reputation with the public and investors.