COMPANY INSIGHT

Sponsored by Medica

Localize or die, or why it is helpful to have a new look at your position in Russia by 2026

It is highly recommended for small and mid-sized medical equipment manufacturers to settle in the Russian b2b market of medical devices before Eurasian Economic Union rules are put into action in 2026

If you have been experiencing difficulties with sales in Russia recently, it is for a reason. You might think about currency rate issues or recession influencing clients’ activity. However, buying less and less imported medical equipment is a state policy in Russia, and it won’t get better.

What is the situation in the medical device market now?

• It is a 4 billion EUR market, where 80% in value or around 3 billion EUR is imported.

• In Russia locally produced medical devices are highly recommended for purchasing, especially within government contracts. The legislation frames are provided by the document called the Government Strategy 2030 and many other regulations.

• Working with local distributors does not guarantee winning the government contracts. It’s quite hard to compete when your winning company gets 15% less of the contract price or is expelled from the government contest altogether when 2 local participants are present. Unfortunately, these are real terms for the imported certified medical devices.

However long and tricky the registration and sales process of medical equipment may seem now, it has two big advantages compared to the EEU rules that will be activated in 2026:

• Current RU certificates for medical equipment (analogue of CE certificates) have no expiration time as for now. It means, having received a registration certificate by 2021, your company still will be able to sell in Russia without receiving an EEU certificate.

• Clinical trials for most of medical devices now can be passed in the form of analysis, without actually repeating them in Russian clinics. After the EEU regulations will be put into action, a medical device producer will have to pass on-site clinical trials in 2 clinics. For sure, it will make the process of registration much more prolonged and expensive.

Considering these facts, the best way for small and medium medical equipment manufacturers to place a foot in the Russian market is to begin the registration process and make certain steps towards localization of their devices. Then by 2026, when more stringent EEU rules will be applied, one could have a local product with a certificate “made in Russia”.

From our experience with Luneau Technology, a French manufacturer of ophthalmological equipment, it is possible to pass all the way from starting registration to launching sales of the partially localized devices in 2-3 years. Yet the correct roadmap for registration and localization is critical in the process. Medica LLC can help both with the roadmap design, the registration itself, as well as assembly, small series production, packaging, labeling and after sales services.

If you email us to the address below and refer to this article, we can schedule for you a 30 minutes free Q&A session on your problems and opportunities in the Russian market of medical equipment.

I

f you have been experiencing difficulties with sales in Russia recently, it is for a reason. You might think about currency rate issues or recession influencing clients’ activity. However, buying less and less imported medical equipment is a state policy in Russia, and it won’t get better.

What is the situation in the medical device market now?

- It is a 4 billion EUR market, where 80% in value or around 3 billion EUR is imported.

- In Russia locally produced medical devices are highly recommended for purchasing, especially within government contracts. The legislation frames are provided by the document called the Government Strategy 2030 and many other regulations.

- Working with local distributors does not guarantee winning the government contracts. It’s quite hard to compete when your winning company gets 15% less of the contract price or is expelled from the government contest altogether when 2 local participants are present. Unfortunately, these are real terms for the imported certified medical devices.

However long and tricky the registration and sales process of medical equipment may seem now, it has two big advantages compared to the EEU rules that will be activated in 2026:

- Current RU certificates for medical equipment (analogue of CE certificates) have no expiration time as for now. It means, having received a registration certificate by 2021, your company still will be able to sell in Russia without receiving an EEU certificate.

- Clinical trials for most of medical devices now can be passed in the form of analysis, without actually repeating them in Russian clinics. After the EEU regulations will be put into action, a medical device producer will have to pass on-site clinical trials in 2 clinics. For sure, it will make the process of registration much more prolonged and expensive.

Considering these facts, the best way for small and medium medical equipment manufacturers to place a foot in the Russian market is to begin the registration process and make certain steps towards localization of their devices. Then by 2026, when more stringent EEU rules will be applied, one could have a local product with a certificate “made in Russia”.

From our experience with Luneau Technology, a French manufacturer of ophthalmological equipment, it is possible to pass all the way from starting registration to launching sales of the partially localized devices in 2-3 years. Yet the correct roadmap for registration and localization is critical in the process. Medica LLC can help both with the roadmap design, the registration itself, as well as assembly, small series production, packaging, labeling and after sales services.

If you email us to the address below and refer to this article, we can schedule for you a 30 minutes free Q&A session on your problems and opportunities in the Russian market of medical equipment.

About Medica LLC

Medica LLC is a subsidiary company of a private venture building company TechnoSpark.

Medica provides localization and registration services for medical device manufacturers.

What do we suggest?

- Localization scheme

- Contract manufacturing

- Selecting and managing local suppliers

- Obtaining all necessary certificates from Russian authorities

- Providing maintenance of the produced equipment

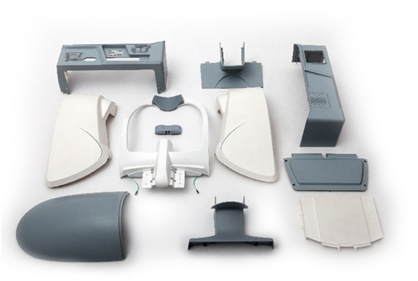

Parts of Visionix VX130 device by LTO, France, localized in Russia by Medica LLC

TechnoSpark Group builds, grows and sells hardware startups and contract technology companies

TechnoSpark Group is a private venture building company that specializes in creating, developing, and selling high-tech startups in hardware industries, from energy storage systems to medical devices.

TechnoSpark cooperates particularly closely with leading international research centers and has years of experience as an industrial partner in the affiliation programs of IMEC and KU Leuven (Belgium), Solliance, Holst, TNO and ECN (Netherlands), Flex Enable (UK), etc. It has two international HQs: at High-Tech Campus Eindhoven, in the Netherlands, and in Tsinghua Science Park, Beijing, China.

Open-contract companies of TechnoSpark provide an opportunity for small series production

Precision metal working / Optical and industrial coatings / Genomics / Microbiology / Integrated electronics/ Flexible electronics / Metal and plastic 3D printers / Composite braiding / Integrated photovoltaics / Synthetic diamonds/ Industrial design

From new green-field near Moscow in 2014 to 7500m² of the technological facilities in 2016