DEALS ANALYSIS

Deals activity: North America leads by value; in vitro diagnostics deals are up

Powered by

Deals activity by geography

Medical industry deals, as captured by GlobalData’s Medical Intelligence Centre, are up year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but recorded the lowest YoY growth in deals volume at 13%. Asia-Pacific, ranking third in terms of deal value, has seen the biggest YoY change, with deal volumes increasing by 92%.

The volume of deals recorded by GlobalData also increased YoY in South and Central America (18%), Europe (33%) and Middle East and Africa (46%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Venture Financing | 136832 | 16343 | 59 |

| Partnership | 14904 | 10598 | 19 |

| Equity Offering | 342868 | 7909 | 128 |

| Acquisition | 1990579 | 7078 | -24 |

| Debt Offering | 1091923 | 2366 | 77 |

| Asset Transaction | 99377 | 1778 | 197 |

| Private Equity | 261564 | 1653 | 99 |

| Grant | 861 | 1631 | 24 |

| Licensing Agreement | 6403 | 671 | 80 |

| Merger | 147285 | 285 | 21956 |

A breakdown of deals by type and volume shows a 21956% growth in mergers YoY, while acquisitions are down 24%, partnerships are up 19% and asset transactions are up 197%. Financing deals have increased across some types, with venture financing up 59% YoY, equity offerings up 128% and debt offerings up 77%.

Private equity has grown by 99% in number of deals YoY, while the number of grants recorded is up 24%.

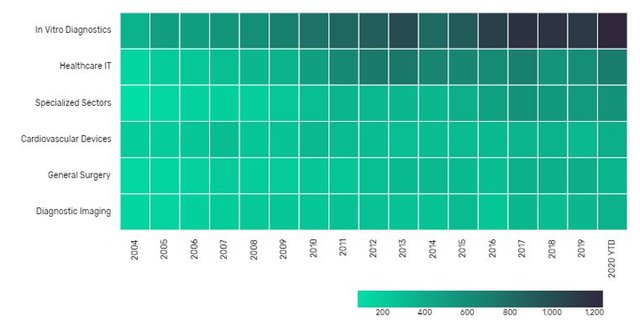

Deals activity by therapy area

The most notable development apparent in GlobalData’s analysis of medical industry deals by therapy area is the increase of deals in the field of in vitro diagnostics. After remaining relatively steady over the past ten years, the number of recorded deals in vitro diagnostics increased significantly in 2020. This is likely due to demand caused by the ongoing Covid-19 pandemic.

Note: All numbers as of 02 November 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Medical Intelligence Centre

Latest deals in brief

Prenetics’ DNAFit Life Sciences acquires Oxsed

Prenetics’s wholly owned UK entity DNAFit Life Sciences has acquired social venture company Oxsed to accelerate the efforts of fighting Covid-19. Based on research from Oxford University, Oxsed has developed a rapid Covid-19 testing platform. With this deal, DNAFit and Prenetics have gained exclusive global rights to Oxsed technology. Named Oxsed RaViD Direct SARS-CoV-2 Test, it is a rapid diagnostic assay for the in vitro qualitative detection of SARS-CoV-2.

Hologic receives US contract to scale-up Covid-19 test production

Eli Lilly has entered a definitive agreement to acquire biotech firm Disarm Therapeutics for an upfront payment of $135m. Under the deal, Disarm’s equity holders may be eligible to receive up to $1.225bn as milestone payments when Eli Lilly develops and commercialises new products resulting from the acquisition. The acquisition will add Disarm’s preclinical SARM1 programmes for axonal degeneration and allow Eli Lilly to expand its R&D efforts in pain and neurodegeneration.

Accuray and Brainlab join forces to target neuro-radiosurgery market

Radiation oncology company Accuray has partnered with Germany-based Brainlab to enhance and expand the capabilities of its CyberKnife platform for the neuro-radiosurgery market. CyberKnife is a robotic, non-invasive radiation therapy device used for the treatment of cancerous and benign tumours throughout the body. It is also intended for the treatment of functional neurologic disorders. Additionally, the platform is also used to treat conditions in the brain while reducing the dose to brain tissues, which play a vital role in functions such as hearing and vision

Bioneb receives £220m investment commitment from Gem Group

UK-based biotech company Bioneb has secured a funding commitment of up to £220m from US investment firm GEM Global Yield. According to the agreement, New York-based GEM will make the investment over a period of 36 months. Bioneb will use the funds to support the ongoing research and development activities for its FDA-approved ultrasonic vibrating mesh drug delivery devices, medical formulations and FDA clinical trials.

Diality raises funds for portable haemodialysis system development

US-based privately held medical device company Diality, which is developing a portable haemodialysis system, has closed a $12.5m Series B investment round. The funding will support the company’s effort in the development of its portable system for acute and chronic haemodialysis. The system is being developed to deliver intense dialysis doses commonly prescribed for patients, receiving three dialysis treatments per week and lower-intensity doses required for more frequent dialysis.

Katena expands instrument operation with Micro-Select acquisition

Katena Products, which develops speciality surgical instruments and consumable ophthalmic and optometric products, has acquired surgical instrument developer Micro-Select Instruments. The financial details of the deal were not disclosed. The acquisition will enable Katena to scale up its manufacturing operations of precision ophthalmic instruments.