Medical devices industry venture financing deals in December 2019 total $1.19bn globally

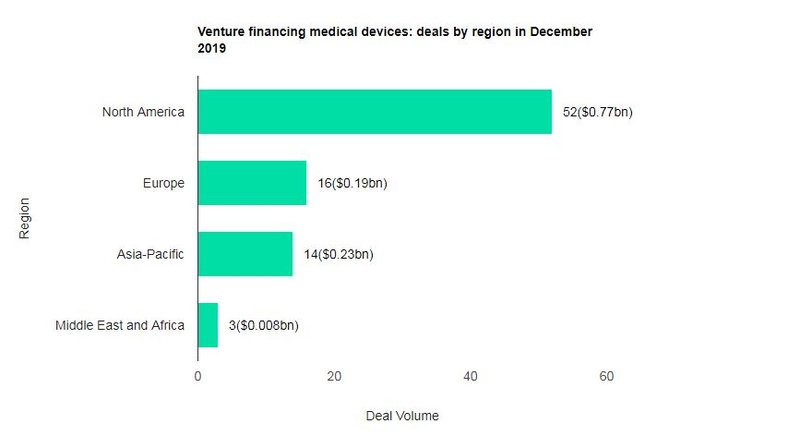

The value marked an increase of 5% over the previous month and a rise of 43.3% when compared with the last 12-month average, which stood at $830.75m. Comparing deals value in different regions of the globe, North America held the top position, with total announced deals in the period worth $769.57m.

At the country level, the US topped the list in terms of deal value at $769.28m. In terms of volumes, North America emerged as the top region for medical devices industry venture financing deals globally, followed by Europe and then Asia-Pacific.

The top five medical devices industry deals of December 2019 tracked by GlobalData were:

1) Foresite Capital Management, JS Capital Management, Merieux Developpement, MLS Capital Fund II, NanoDimension Management, Oak HC/FT Partners, Paladin Capital Group and Venrock’s $125m venture financing of Inscripta

2) The $114.39m venture financing of Geneseeq Technology by China ReformLtd, Lilly Asia ventures and Softbank China Venture Capital

3) 3H Health Investment, Ally Bridge Group, Ascension Ventures, Bain Capital Life Sciences, Delos Capital, Incept and Rock Springs Capital Management’s $85m venture financing of Imperative Care

4) The $85m venture financing of Sonendo by ArrowMark Partners, Broadfin Capital, CVF, Essex Woodlands Management, General Atlantic, JMR Capital, Meritech Capital Partners, NeoMed Management, Orbimed Advisors, Perceptive Advisors, Redmile Group, SEB Private Equity and Security Pacific Finance

5) Abiomed, Acorn Bioventures, Amzak Health, Kennedy Lewis Investment Management, Minth Investment, Wellington ManagementLLP and Zoll Medical’s venture financing of Impulse Dynamics for $80.25m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Biodesix and Streck sign agreement to secure FDA approval for products

Lung cancer diagnostic solutions company Biodesix and Streck have signed a regulatory cooperation agreement to secure FDA approval for diagnostic testing services and specimen collection products.

Under the agreement, the companies will share goals to obtain approvals for Biodesix Diagnostic Testing and Streck Blood Collection Tubes.

Earlier, Biodesix announced plans to seek approval from the FDA for future genomic tests on Next Generation Sequencing (NGS) and Droplet Digital PCR (ddPCR) platforms as companion diagnostics.

With the latest partnership, Streck’s proprietary blood collection tubes (BCTs) and preservatives can be integrated into Biodesix’s sample collection protocols.

Smith+Nephew acquires Tusker Medical to expand ENT portfolio

UK-based medical equipment manufacturer Smith+Nephew has acquired Tusker Medical for an undisclosed amount.

Based in California, Tusker Medical has developed the Tula system for tympanostomy tubes, also called ear tubes, to treat recurrent or persistent ear infections. The acquisition is part of Smith+Nephew’s strategy to invest in advanced technologies to meet fulfilled medical requirements.

Emboline completes $5m bridge round of financing

Embolic protection catheter company Emboline has announced the closing of a $5m bridge round of financing, ahead of an expected Series C funding round later this year. The money will support Emboline in filing for CE Mark approval of its Emboliner embolic protection catheter, as well as preparing for commercial launch in Europe and a pivotal trial in the US.

Brainlab acquires San Diego-based VisionTree Software

Germany-based digital medical technology company Brainlab has acquired VisionTree Software for an undisclosed amount.

Based in San Diego, US, VisionTree Software is associated with the development of cloud-based and patient-centric data collection and health management solutions.

Liquid biopsy developer Elypta raises €6m in late seed round

Swedish molecular diagnostics firm Elypta has raised €6m in a late seed funding round led by Industrifonden and Sciety.

The company intends to use the funds to complete the development of lab kits and software for the measurement and analysis of metabolic biomarkers, which company leaders have determined as most promising for cancer diagnostics.