Robotics in medtech are primed for significant growth to end a bumpy 2020

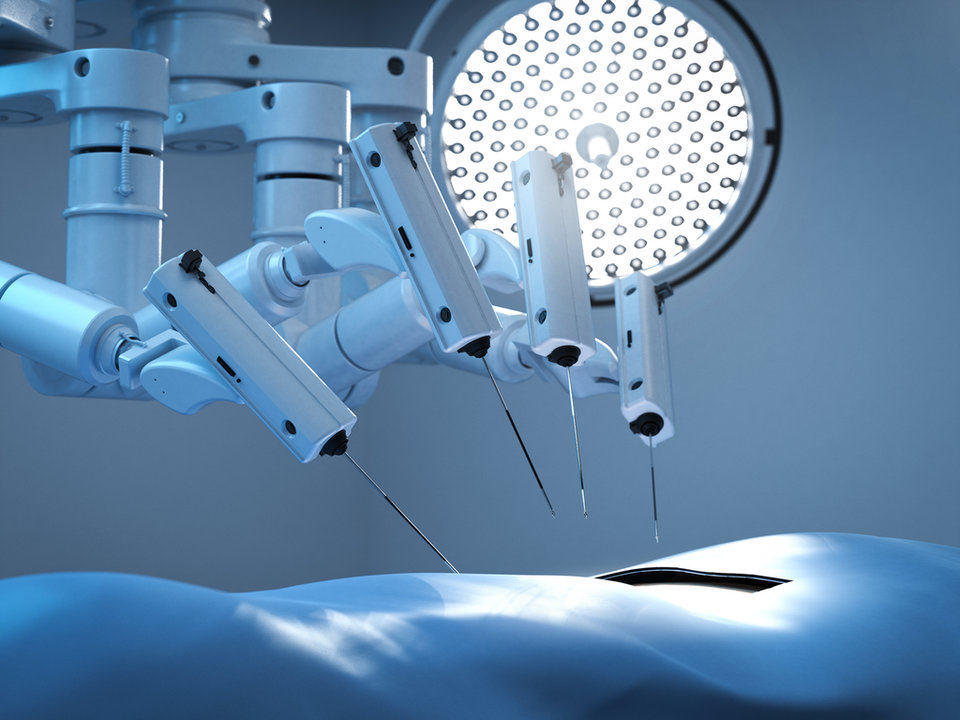

Medical robotics has been the subject of major R&D over the past 20 years. This was driven by the substantial investments made in the industry after the da Vinci Surgical System became the first robotic surgical system approved by the US Food and Drug Administration (FDA), in 2000.

Robotic systems are commonly used in elective surgery procedures and many patients were deferred due to the Covid-19 pandemic. As a result, the demand for these devices dropped during Q2 2020 and medical device companies saw their sales plunge. However, recent Q3 earnings posted by leading companies such as Zimmer Biomet and Stryker Corp show that this is no longer the case, as global levels of elective surgery continued to recover.

Zimmer recently released its Q3 earnings, which exceeded analyst expectations. Net sales increased by 2% compared to the previous year—a significant improvement from the 38% year-over-year decline in Q2. Similarly, Stryker reported net sales increased by 4.2% in the third quarter compared to a 24.3% decrease in the previous quarter.

There are further developments to be made in this field that contribute to its growth, most notably the shift to preventative care and improving the quality of life for elderly patients by using less-invasive procedures. Nanosurgery is another new development, in which surgeons can use micro-robots to operate at the cellular level.

Robotics is set to see significant growth in medical over the next few years after experiencing an unstable period in 2020, and the global market value for robotics is projected to surpass $275bn by 2025, up from $115bn in 2019.

Robotics companies are making a remarkable recovery in Q3 and are setting up for a strong comeback in the final quarter of 2020.

For more insight and data, visit GlobalData's Medical Intelligence Centre

Market Insight from