Medical devices industry private equity deals in Q2 2020 total $1.68bn globally

The value marked an increase of 94.7% over the previous quarter and a rise of 81.6% when compared with the last four-quarter average, which stood at $922.8m.

Comparing deals value in different regions of the globe, Asia-Pacific held the top position, with total announced deals in the period worth $725.87m. At the country level, China topped the list in terms of deal value at $722.6m.

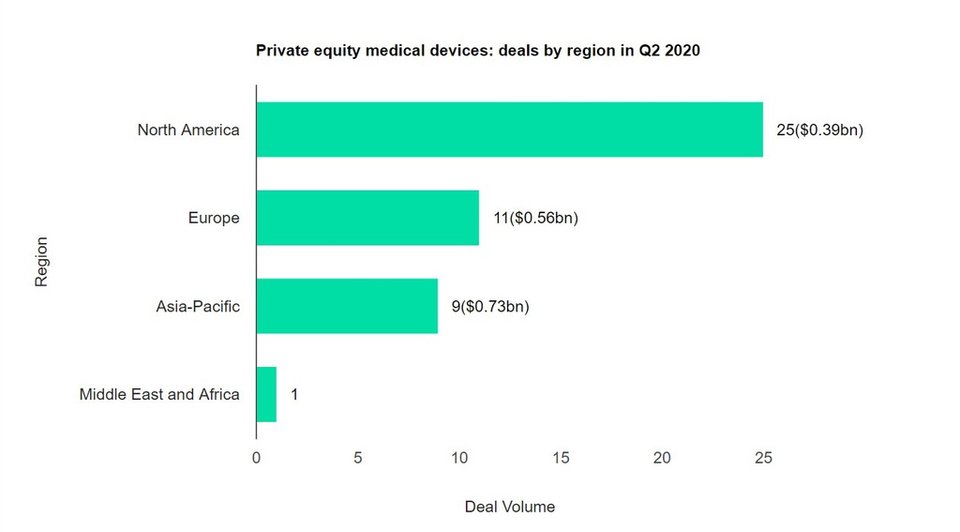

In terms of volumes, North America emerged as the top region for medical devices industry private equity deals globally, followed by Europe and then Asia-Pacific.

The top country in terms of private equity deals activity in Q2 2020 was the US with 23 deals, followed by China with eight and Belgium with two.

The combined value of the top five medical devices private equity deals stood at $1.11bn, against the overall value of $1.68bn recorded for the month.

The top five medical devices industry deals of Q2 2020 tracked by GlobalData were:

1) Beijing Strong Biotechnologies and Sinopharm Group’s $367.87m private equity deal with Fuzhou Maixin Biotechnology Development

2) The $337m private equity deal with Medtronic by The Blackstone Group

3) Hillhouse Capital Group and Temasek Fullerton Alpha Pte.’s $154.52m private equity deal with Shanghai Kinetic Medical

4) The $135.89m private equity deal with Abcam by Durable Capital Partners

5) Friend Capital, Guangzhou Boyi Architectural Design Institute, Meinian Onehealth Healthcare GroupLtd , New Alliance Capital, Red Horse Investment Group, Sinopec Capital and Xin Ding Capital’s private equity deal with CapitalBio for $112.98m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Wenzel Spine acquires spine imaging analytics firm Statera Spine

US-based medical technology company Wenzel Spine has acquired software-enabled spine imaging analytics company Statera Spine.

The acquired company provides pre-operative diagnostics and quantitative data software solution that improves treatment decisions for patients with chronic and acute spine issues.

Its ProfileESP, Vertebral Motion Analysis technology and integrated Surgical Planning Solution is expected to further fortify Wenzel’s existing spine fusion-related product portfolio by adding key diagnostic and decision-making tools.

Philips to buy Intact Vascular to bolster image-guided therapy business

Royal Philips has agreed to acquire US-based medical devices firm Intact Vascular, which specialises in minimally invasive peripheral vascular procedures, for an upfront cash consideration of $275m. The deal also includes deferred payments for which the company expects to recognise a provision of $85m upon closing of the transaction.

The acquisition will enable Philips to enhance its image-guided therapy portfolio. Furthermore, Intact Vascular’s implantable device combined with the company’s interventional imaging platform and diagnostic and therapeutic devices is expected to enhance the treatment for Peripheral Artery Disease.

TEAM Technologies acquires medical speciality manufacturer Baril

TEAM Technologies has acquired medical speciality manufacturer Baril to expand die-cutting and laminating of medical materials for skin-contacting device solutions.

The acquired company manufactures infection prevention, wound care, clinical chemistry, patient monitoring, and medical and surgical consumable products.

Sulzer to acquire drug delivery device developer Haselmeier for €100m

Biotechnology company Rakuten Medical acquires Medlight

Global biotechnology firm Rakuten Medical has announced the acquisition of Swiss medical company Medlight SA.

Medlight’s acquisition enables Rakuten Medical to have a network of ‘well-qualified subcontractors’, creating a path for the quick development of new optical devices under the European and the US medical regulatory standards.