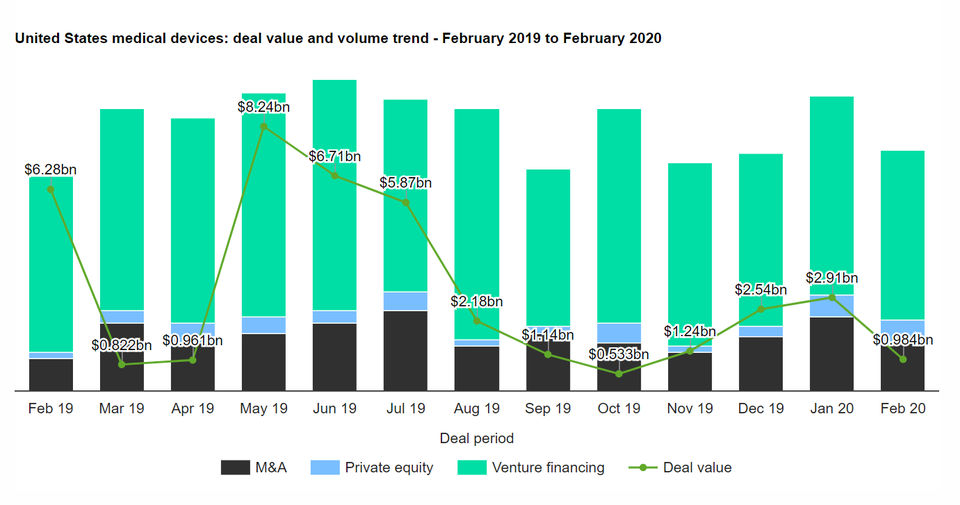

US medical devices industry sees a drop of 9.6% in deal activity in February 2020

A total of 75 deals worth $984.24m were announced in February 2020, compared to the 12-month average of 83 deals.

Venture financing was the leading category in the month in terms of volume with 53 deals which accounted for 70.7% of all deals. In second place was M&A with 15 deals, followed by private equity with seven transactions, respectively accounting for 20% and 9.3% of overall deal activity in the country’s medical devices industry during the month.

In terms of value of deals, venture financing was the leading deal category in the US medical devices industry with total deals worth $760.99m, while M&A and private equity deals totalled $146.2m and $77.04m, respectively.

The top five medical devices industry deals of February 2020 tracked by GlobalData were:

1) General Catalyst Partners, HBM Healthcare Investments, Khosla Ventures, Lightspeed Management Company and SoftBank Vision Fund’s $165m venture financing of Karius

2) The $125m venture financing of Outset Medical by D1 Capital Partners, Fidelity Management & Research, Partner Fund Management, Perceptive Advisors and T. Rowe Price Group

3) 11.2 Capital, Atomico Ventures, Bessemer Venture Partners, Heuristic Capital Partners Management Co, Insight Partners, Lead Edge Capital Management and Quadrille Capital’s $90m venture financing of Hinge Health

4) The $50m private equity deal with JenaValve Technology by Bain Capital Life Sciences, Andera Partners, Gimv, Legend Capital, NeoMed Management, RMM Capital, Valiance Partners and VI Partners

5) Ligand Pharmaceuticals’ asset transaction with Icagen for $40m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Insightec raises $150m to support treatment of movement disorders

Israel-based medical technology company Insightec has signed a definitive agreement for funding of about $150m to support continued research to evaluate focused ultrasound for the treatment of certain movement disorders. Series F financing at a post-money valuation of $1.3bn is led by Koch Industries’ subsidiary Koch Disruptive Technologies (KDT), which has committed to invest $100m at an initial closing to follow shareholder approval.

Forescout and Medigate partner to secure medical IOT devices

Forescout Technologies has entered a strategic partnership with medical device security solution Medigate to help secure the Internet of Medical Things (IoMT), IoT, operational technology and IT network-connected devices. The partnership enables Forescout to resell the Medigate Platform. As part of the collaboration, the companies have developed an integration to combine Medigate’s in-depth IoMT visibility with Forescout’s enterprise device visibility.

Medigate allows info security, IT, biomedical and clinical engineering teams to detect, monitor and secure every medical device on the clinical network.The platform’s medical device classification and information will enable Forescout to apply granular access control, segmentation and other compliance policies for clinical networks.

Thermo Fisher Scientific to acquire Qiagen in $11.5bn deal

Element Science raises $145.6m through Series C funding round

US-based medical device and digital health company Element Science has raised $145.6m through a Series C funding round to boost its next-generation digital wearable platform. The proceeds from the round will go towards the completion of clinical studies and the commercial launch of the company’s first product.

ATEC signs agreement to acquire EOS imaging

Medical device company Alphatec Holdings (ATEC) has signed an agreement to acquire Paris-based EOS imaging.

The deal, a combination of cash and equity, includes a purchase price of up to $88m and debt retirement of $33.9m.