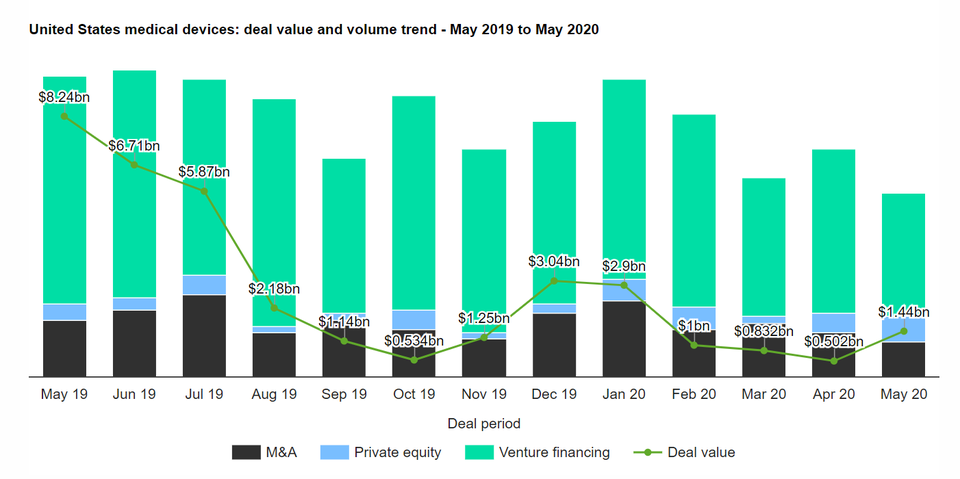

US medical devices industry sees a drop of 30.1% in deal activity in May 2020

A total of 58 deals worth $1.44bn were announced in May 2020, compared to the 12-month average of 83 deals.

Venture financing was the leading category in the month in terms of volume with 39 deals which accounted for 67.2% of all deals.

In second place was M&A with 11 deals, followed by private equity with eight transactions, respectively accounting for 19% and 13.8% of overall deal activity in the country’s medical devices industry during the month.

In terms of value of deals, venture financing was the leading deal category in the US medical devices industry with total deals worth $1.26bn, while private equity and M&A deals totalled $145.24m and $41.6m, respectively.

The top five medical devices industry deals of May 2020 tracked by GlobalData were:

1) Canada Pension Plan Investment Board, Illumina and Public Sector Pension Investment Board’s $390m venture financing of Grail

2) The $194m venture financing of American Well by Allianz X and Takeda Pharmaceutical

3) Ally Bridge Group, Asahi Kasei Medical, Bain Capital Life Sciences, Endeavour Vision, Longitude Capital Management Co, Quaker Partners Management and Xeraya Capital Sdn’s $120m venture financing of Rapid Micro Biosystems

4) The $100m venture financing of Mindstrong by 8VC, Foresite Capital Management, General Catalyst Partners, Optum Ventures and What If Ventures

5) AME Cloud Ventures, Andreessen Horowitz Cultural Leadership Fund, Bezos Expeditions, Bolt Innovation Management, Defy Partners Management, Madrona Venture Group, Perceptive Advisors and Vulcan Capital Management’s venture financing of Ignite Biosciences for $76m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

OneProjects receives funding for cardiac imaging system development

Irish-German medical device start-up OneProjects has raised $12m in a Series A financing round led by Dutch investment company LSP and the Atlantic Bridge University Fund.

Enterprise Ireland and a number of prominent MedTech entrepreneurs also participated in the financing round.

The company intends to use the fund to advance its product development and launch clinical trials.

It will also support the market launch of Verafeye, a connected platform technology developed by the company for the treatment of atrial fibrillation (AFib) and cardiac arrhythmias.

inHEART raises fresh funds to expand treatments for cardiac arrhythmia

France-based inHEART has secured additional funding to support the development of artificial intelligence (AI), medical imaging and numerical simulations of cardiac arrhythmias.

The company has raised $4.2m in a financing round led by Elaia, a venture capital company focused on European digital and deep-tech startups.

inHEART plans to use the proceeds to accelerate its commercial development in Europe and to foray into the US market.

Foldax raises capital to fund development of surgical heart valves

Heart valve startup Foldax has raised $20m in a Series D financing round led by Memorial Care Innovation Fund. The round was also joined by the company’s existing investors, including BioStar Capital, Kairos Ventures and Caltech, while Angel Physicians Fund and Sayan Bioventures joined as new investors.

BrightInsight raises funds to develop digital platform for biopharma

Keystone Heart acquires medical device maker 510 Kardiac Devices

Israeli company Keystone Heart has acquired privately held medical device company 510 Kardiac Devices for an undisclosed amount.

The acquired company is developing Lim Transseptal System to fulfil the demands of left-sided structural heart procedures that require a transseptal approach.