Medical devices industry private equity deals in Q1 2020 total $927.27m globally

The value marked a decrease of 54.5% over the previous quarter and a drop of 13.03% when compared with the last four-quarter average, which stood at $1.07bn.

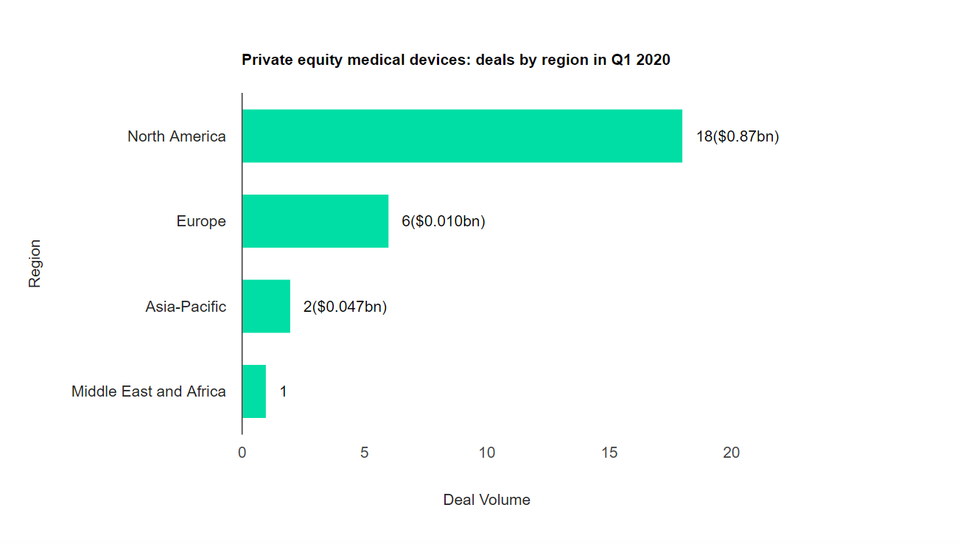

Comparing deals value in different regions of the globe, North America held the top position, with total announced deals in the period worth $870.38m. At the country level, the US topped the list in terms of deal value at $810.3m.

In terms of volumes, North America emerged as the top region for medical devices industry private equity deals globally, followed by Europe and then Asia-Pacific. The top country in terms of private equity deals activity in Q1 2020 was the US with 16 deals, followed by the UK with three and Canada with two.

Medical devices industry private equity deals in Q1 2020: Top deals

The combined value of the top five medical devices private equity deals stood at $700.2m, against the overall value of $927.27m recorded for the month.

The top five medical devices industry deals of Q1 2020 tracked by GlobalData were:

1) Montagu Private Equity’s $490m private equity deal with RTI Surgical Holdings

2) The $81m private equity deal with Zap Surgical Systems by Chow Tai Fook Enterprises, Hogy Medical, Primavera Capital Group and Shangbay Capital

3) Bain Capital Life Sciences, Andera Partners, Gimv, Legend Capital, NeoMed Management, RMM Capital, Valiance Partners and VI Partners’ $50m private equity deal with JenaValve Technology

4) The $40m private equity deal with Medsphere Systems by TPG Sixth Street Partners

5) Global Emerging Markets’ private equity deal with Avisa Pharma for $39.2m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Novartis expands ophthalmology pipeline with Amblyotech acquisition

Novartis has acquired US-based software startup Amblyotech, which is developing a digital treatment for amblyopia (lazy eye) that leads to vision loss in children and young adults.

Financial details of the transaction are yet to be divulged by either company.

Amblyopia impacts approximately 3% of the population worldwide. Some of these patients could be eligible for Amblyotech’s therapy, if approved, said Novartis.

Existing treatment options, including patching and atropine, have low compliance and low success rates. In addition, adults have limited approved therapies.

Insightec raises $150m to support treatment of movement disorders

Israel-based medical technology company Insightec has signed a definitive agreement for funding of about $150m to support continued research to evaluate focused ultrasound for the treatment of certain movement disorders.

Series F financing at a post-money valuation of $1.3bn is led by Koch Industries’ subsidiary Koch Disruptive Technologies.

This is the second direct investment by the company in Insightec.

Forescout and Medigate partner to secure medical IOT devices

Forescout Technologies has entered a strategic partnership with medical device security solution Medigate to help secure the Internet of Medical Things (IoMT), IoT, operational technology (OT) and IT network-connected devices.

Thermo Fisher Scientific to acquire Qiagen in $11.5bn deal

Element Science raises $145.6m through Series C funding round

US-based medical device and digital health company Element Science has raised $145.6m through a Series C funding round to boost its next-generation digital wearable platform.