Market insight in association with

Spend wisely: monetisation planning in the healthcare industry

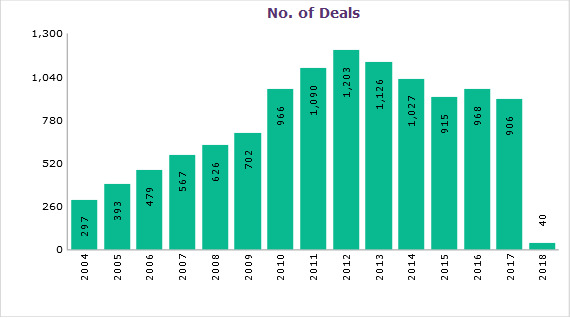

Investing into the healthcare industry is always a gamble. Government regulations and scientific limitations are two of many factors that not only influence, but dictate the success or failures of a company in the healthcare industry. Nevertheless, venture capital investors made a significant impact in providing financing options for healthcare companies from 2004 to 2012.

Interestingly, when monitoring these investment transactions since 2012, the number of venture financing deals in the healthcare sector has steadily decreased. Although the investment into the pharmaceutical sector is less of a concern, the medtech industry is the driving force behind the decrease in ability to raise venture capital.

Outliers, of course, do exist. In 2017, Grail, a medical device company that develops devices to detect cancer in its early stages, raised $914m from heavy hitters like Johnson & Johnson Innovation and Amazon.com. But the fact remains that there is a general decreasing trend in venture financing in the healthcare sector.

Global venture financing deals, 2004-2018

Source: GlobalData, Medical Intelligence Center [Accessed 26 January 2018]

There isn’t a lack of innovation; investors see hundreds of novel ideas on a regular basis. The issue is the lack of monetisation planning by these idea-driven companies. Companies fail to recognise the importance of both short-term and long-term returns for investors. The average value of venture investment has remained somewhat consistent for the last five years, at $8.48m.

However, leveraging capital into company success is, now more than ever, the subject of discussion. Large investment advisors and banks involved in these transactions need to provide monetisation planning expertise tailored for each company. Without this service, investors will continue to turn away from idea-driven healthcare companies.

So far in 2018, 40 complete venture financing transactions have already occurred. A notable deal is by Metavention, a medical device company founded in 2012, which is working to optimise metabolic neuromodulation therapy for glucose in patients with type 2 diabetes. The company raised $65m through series C venture financing, having multiple investors in its pocket. It will be interesting to see if a company like Metavention can set an example in making good use of investors’ money.