DEALS ANALYSIS

Deals activity: Global deals increase YoY; partnership deals continue to rise

Powered by

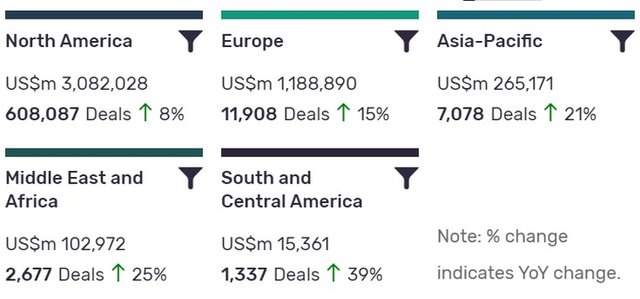

Deals activity by geography

Medical industry deals, as captured by GlobalData’s Medical Intelligence Centre, are up year-on-year (YoY) across the majority of regions.

North America is leading in terms of deal value, but recorded the lowest YoY growth in deals volume, at 8%. Asia-Pacific, ranking third in terms of deal value, has also seen notable YoY change, with deal volumes increasing by 21%.

The volume of deals recorded by GlobalData also increased YoY in Europe (15%) and Middle East and Africa (25%), but declined in South and Central America (39%).

Deals activity by type

| Deal type | Total deals value ($m) | Total deal count | YoY change (volume) |

| Venture Financing | 157,285 | 17,485 | 74 |

| Partnership | 15,276 | 11,004 | 121 |

| Equity Offering | 399,998 | 8,544 | 59 |

| Acquisition | 2,071,643 | 7,476 | 0 |

| Debt Offering | 1,141,124 | 2,498 | -27 |

| Asset Transaction | 100,277 | 1,831 | -25 |

| Private Equity | 301,634 | 1,796 | 292 |

| Grant | 203,035 | 572,814 | 14 |

| Licensing Agreement | 6,608 | 688 | 45 |

| Merger | 156,060 | 316 | 32,027 |

A breakdown of deals by type and volume shows a 32,027% growth in mergers YoY, while acquisitions are at 0%, partnerships are up 121% and asset transactions are down 25%. Financing deals have increased across some types, with venture financing up 74% YoY and equity offerings up 59%, while debt offerings are down 27%.

Private equity has grown by 292% in number of deals YoY, while the number of grants recorded is up 14%.

Deals activity by therapy area

A notable development apparent in GlobalData’s analysis of medical industry deals by therapy area is the increase of in vitro diagnostics deals. After remaining relatively steady, the number of recorded in vitro diagnostics deals increased significantly in 2020/21. This is likely due to demand caused by the ongoing Covid-19 pandemic.

Note: All numbers as of 01 June 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Medical Intelligence Centre

Latest deals in brief

Kailo Medical and Medo AI partner on thyroid ultrasound diagnosis

Australian company Kailo Medical has partnered with artificial intelligence (AI) firm Medo to incorporate Medo Thyroid into its SonoReview product, which will offer rapid nodule classification.

PENTAX and Vedkang form JV for endoscopic device development

HOYA Group’s PENTAX Medical and Jiangsu Vedkang Medical Science and Technology have formed a joint venture (JV) to create single-use, flexible medical endoscopic therapeutic products.

Olympus acquires Israeli medical device firm Medi-Tate

Olympus has acquired Israeli medical device company Medi-Tate to enhance its business portfolio for in-office treatment of benign prostatic hyperplasia. The company noted that the deal will boost Olympus’ position in the urological devices segment.

Akili raises $160m to market cognitive disorder treatment for children

Akili Interactive has raised $160m in combined equity and debt financing to support the commercialisation of its video game treatment, EndeavorRx, which enhances attention function in children with attention deficit hyperactivity disorder.

Nextphase acquires Proven Process to boost device R&D capabilities

NextPhase Medical Devices has acquired US-based company Proven Process Medical Devices to bolster its capabilities in research and development (R&D), engineering, design and production of various devices. These devices include US Food and Drug Administration Class II and III therapeutics and diagnostics.

Quest Diagnostics and Paige partner to develop cancer diagnostics

Quest Diagnostics has partnered with Paige to develop software products leveraging AI to enhance and expedite the pathologic diagnoses of cancer and various other diseases. Using Paige’s machine learning capabilities, the partnership will analyse pathology diagnostic data and digitised slides from Quest, as well as its AmeriPath and Dermpath units to identify markers of cancer and other indications.