DEALS ANALYSIS

Deals activity: Middle East and Africa lead YoY; debt offering deals continue to rise

Powered by

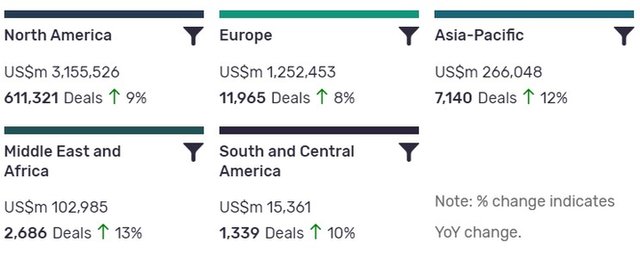

Deals activity by geography

Medical industry deals, as captured by GlobalData’s Medical Intelligence Centre, are up year-on-year (YoY) across the majority of regions.

North America is leading in terms of deal value, but recorded the second-lowest YoY growth in deals volume, at 9%. Asia-Pacific, ranking third in terms of deal value, has also seen YoY change, with deal volumes increasing by 12%.

The volume of deals recorded by GlobalData also increased YoY in Europe (8%), Middle East and Africa (13%) and in South and Central America (10%).

Deals activity by type

| Deal type | Total deals value ($m) | Total deal count | YoY change (volume) |

| Venture Financing | 158,533 | 17,600 | 73 |

| Partnership | 15,307 | 11,054 | 34 |

| Equity Offering | 402,815 | 8,598 | 35 |

| Acquisition | 2,165,850 | 7,504 | 2 |

| Debt Offering | 1,146,016 | 2,506 | -33 |

| Asset Transaction | 100,392 | 1,848 | -29 |

| Private Equity | 332,060 | 1,808 | 464 |

| Grant | 204,308 | 575,886 | 15 |

| Licensing Agreement | 6,621 | 692 | 45 |

| Merger | 158,860 | 321 | 35,240 |

A breakdown of deals by type and volume shows a 35,240% growth in mergers YoY, while acquisitions are at 2%, partnerships are up 34% and asset transactions are down -29%. Financing deals have increased across some types, with venture financing up 73% YoY and equity offerings up 35%, while debt offerings are down -33%.

Private equity has grown by 464% in number of deals YoY, while the number of grants recorded is up 15%.

Deals activity by therapy area

A notable development apparent in GlobalData’s analysis of medical industry deals by therapy area is the increase of diagnostic imaging deals.

After remaining relatively steady in 2020, the number of recorded diagnostic imaging deals continues to lead the pack, with 7,953 deals recorded so far in 2021; however, specialised sectors remains a close challenge for the top spot, with 7,440 deals to-date in 2021.

Note: All numbers as of 22 June 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Medical Intelligence Centre

Latest deals in brief

Cala Health and UCSF to develop neuromodulation therapies

Cala Health has collaborated with the University of California, San Francisco (UCSF) to develop tailored peripheral nerve stimulation treatments based on Cala Health’s neuromodulation and data science technology.

Hologic concludes acquisition of Mobidiag for $808m

Hologic has completed the acquisition of Finnish-French molecular diagnostic test developer Mobidiag for an enterprise value of nearly $808m. Mobidiag develops near-patient, molecular diagnostic instruments and tests for acute care conditions.

Organon closes $240m acquisition of Alydia Health

Merck spinoff company Organon has concluded the acquisition of a commercial-stage medical device company, Alydia Health, for a total consideration of up to $240m. In March, Merck signed a definitive agreement to acquire Alydia Health on behalf of Organon for an upfront cash payment of $215m and a potential milestone payment of $25m.

Novo Holdings acquires BBI Group from Exponent for $564m

Novo Holdings has acquired diagnostic products and services supplier BBI Group from Exponent for an enterprise value of more than $564m (£400m). Established in 1986, BBI supplies a variety of products to diagnostics and life sciences industries globally.

ALBOT obtains licence to develop Covid-19 tests in India

ALBOT USA and ALBOT Technologies India have obtained a licence from Sherlock Biosciences’ 221b Foundation to develop, produce and distribute Covid-19 diagnostic tests using the latter’s CRISPR technology. Currently, ALBOT has a capacity to produce up to 30,000 units daily, boosting access in a region with high numbers of Covid-19 cases and emergent variants.

Circle and DiA Imaging partner on AI-based cardiovascular solutions

Circle Cardiovascular Imaging and DiA Imaging Analysis have entered a multi-year collaboration to offer all-in-one artificial intelligence (AI)-based cardiovascular imaging solutions. The partners will use their respective expertise in cardiac AI and data analytics.