Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 22 July

The global economy is forecast to return to pre-crisis levels by the end of 2021 or early 2022.

The jobless rate in the Euro area stood at 7.9% in May 2021, as compared to 8.1% in April 2021, according to Eurostat.

4.8%

The European Commission has revised the economic growth rate of the EU upward to 4.8% in 2021. It estimates the EU will reach pre-pandemic level output by the last quarter of 2021.

4%

The World Bank has downgraded the economic growth forecast for East Asia and the Pacific, excluding China, to 4% in 2021 from its earlier projection of 4.4% in March.

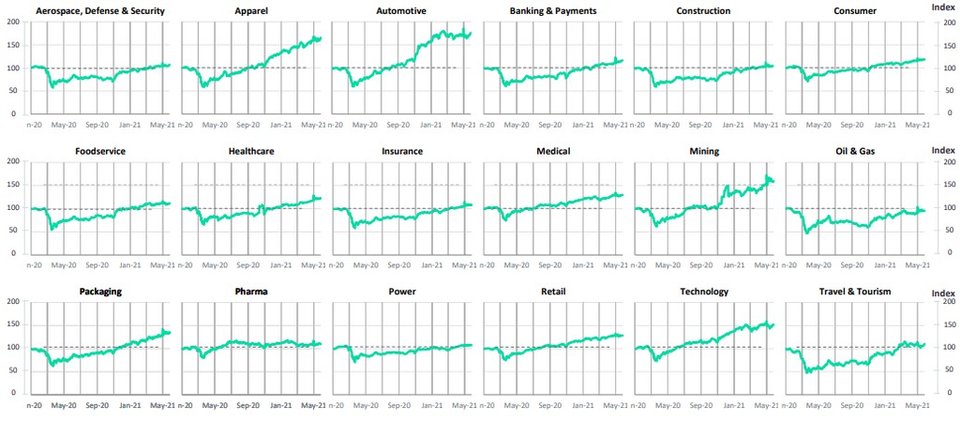

Impact of Covid-19 on equity indices

- SECTOR IMPACT: MEDICAL DEVICES -

Latest update: 07 July

Covid-19 sector impact

$16.8bn

GlobalData expects the anaesthesia & respiratory devices market segment to reduce in value from $20.7bn in 2020 to $16.8bn in 2021, due to successful rollouts of Covid-19 vaccines in some countries.

18%

According to GlobalData’s robotic surgical systems market analysis, the market value of robotic surgical systems in the US in 2020 was negatively impacted by more than 18% due to the Covid-19 crisis.

Medical value chain impact

Short-term impact

Logistics and dearth of device components supplies will be major issues for all. Most medical companies will show a decline in revenues in Q1 and Q2 due to the limited number of procedures being done.

Mid-term impact

As concerns over availability of materials subside, manufacturing process will begin to resume, though will initially lag relative to regular operations.

Developers of Covid-19 interventions could thrive; the bulk of the industry will be challenged with supply chain interruptions and limited procedures. Growth will be derived from opportunities to manufacture and support distribution of Covid-19 tests and test capabilities.

Long-term impact

The need for devices will grow above pre-Covid-19 levels due to the increased number of procedures to catch up with the delay. Sales volumes will increase as devices are sold to make up for the lack of procedures in early 2020.

Key Medical device market developments