Medical devices industry venture financing deals in Q2 2020 total $2.44bn in US

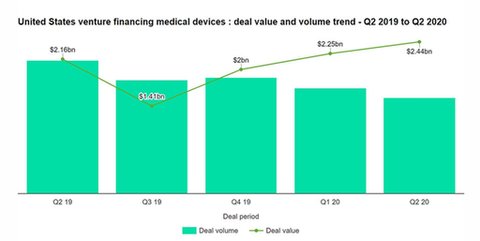

Total medical devices industry venture financing deals in Q2 2020 worth $2.44bn were announced in the US, according to GlobalData’s deals database.

The value marked an increase of 11.4% over the previous quarter and a rise of 24.9% when compared with the last four-quarter average of $1.96bn.

The US held a 53.2% share of the global medical devices industry venture financing deal value that totalled $4.59bn in Q2 2020.

In terms of deal activity, the US recorded 154 deals during Q2 2020, marking a drop of 9.4% over the previous quarter and a drop of 18.5% over the last four-quarter average.

The top five medical devices industry venture financing deals accounted for 37.02% of the overall value during Q2 2020.

The combined value of the top five medical devices venture financing deals stood at $904m, against the overall value of $2.44bn recorded for the month.

The top five medical devices industry deals of Q2 2020 tracked by GlobalData were:

1) Canada Pension Plan Investment Board, Illumina and Public Sector Pension Investment Board’s $390m venture financing of Grail

2) The $194m venture financing of American Well by Allianz X and Takeda Pharmaceutical

3) Ally Bridge Group, Asahi Kasei Medical, Bain Capital Life Sciences, Endeavour Vision, Longitude Capital Management Co, Quaker Partners Management and Xeraya Capital Sdn’s $120m venture financing of Rapid Micro Biosystems

4) The $100m venture financing of Mindstrong by 8VC, Foresite Capital Management, General Catalyst Partners, Optum Ventures and What If Ventures

5) ACME Capital, Decheng Capital, Foresite Capital Management, Johnson & Johnson Innovation – JJDC and Madrone Capital Partners’ venture financing of Cue Health for $100m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Siemens Healthineers to acquire Varian Medical for $16.4bn

Germany-based medical device company Siemens Healthineers has signed an agreement to acquire US-based radiation oncology treatment solutions provider Varian Medical Systems in a $16.4bn deal.

According to the agreed transaction, Siemens will receive all Varian shares for $177.50 each in cash. The company plans to finance the acquisition with a mix of debt and equity.

Varian specialises in the field of cancer care and is active in the area of oncology research and therapy.

The acquisition is expected to help Siemens to enter the cancer research and therapeutics markets.

Alydia raises funds to support launch of haemorrhage device

Alydia Health has raised fresh funds to support the US commercial launch of the suction device for the treatment of postpartum haemorrhage.

Called Jada System, the device stops postpartum haemorrhaging within a few minutes. The company recently completed the pivotal PEARLE IDE Study of the system and is currently awaiting the market clearance from the US Food and Drug Administration.

The $13.9m Series C financing round was led by AXA Investment Managers through the Impact Investing Strategy.

Thrive raises $257m to fund multi-cancer diagnostic test trial

Thrive Earlier Detection has raised $257m in a Series B financing round to fund the registrational trial of the multi-cancer diagnostic test CancerSEEK.

The round was led by Casdin Capital and Section 32. It was joined by multiple new investors, including Bain Capital Life Sciences, Brown Advisory, Driehaus Capital Management and Intermountain Ventures.

Eargo raises $71m to expand commercialisation of hearing loss solution

Nanox raises fresh funds to commercialise ‘digital X-ray’ device

Israeli start-up Nanox has secured another $59m in funding to mainly fund the global launch of the in-hospital imaging device Nanox.ARC.

Including the latest investment, the company has raised a total of $110m in the Series B funding round since November last year.