Medical devices industry venture financing deals in April 2020 total $898.52m globally

Comparing deals value in different regions of the globe, North America held the top position, with total announced deals in the period worth $418.2m. At the country level, the US topped the list in terms of deal value at $418.2m.

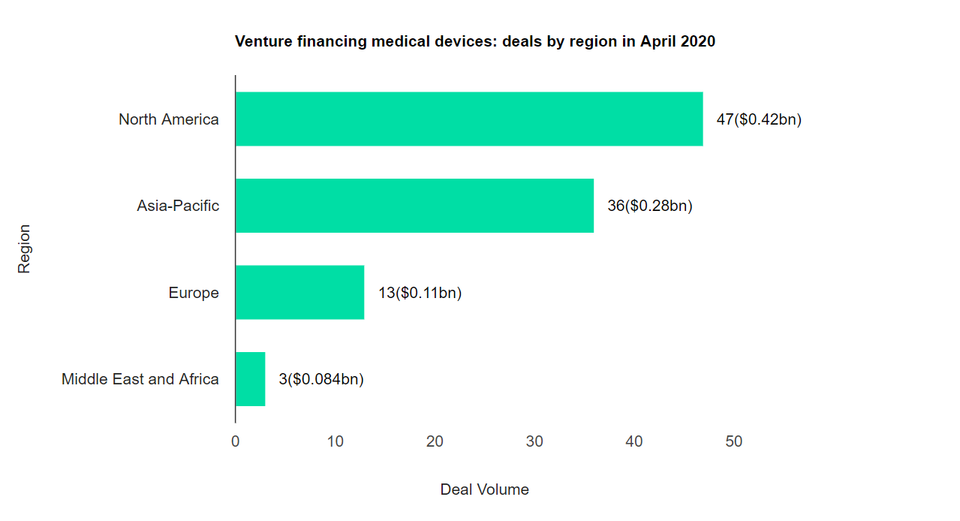

In terms of volumes, North America emerged as the top region for medical devices industry venture financing deals globally, followed by Asia-Pacific and then Europe.

The top country in terms of venture financing deals activity in April 2020 was the US with 47 deals, followed by China with 26 and the UK with five.

Medical devices industry venture financing deals in April 2020: Top deals

1) BANK OF CHINA INVESTMENT MANAGEMENT, Chongqing Science and Technology Venture Capital, Guangdong Zhutou Innovation, Langmafeng Venture Capital, Qianhai Mother Fund, Telford Capital and Yoyin Medical Fund’s $84.98m venture financing of Guangzhou Huayin Health Technology

2) The $70m venture financing of Click Diagnostics by Cedars-Sinai Medical Center, John Doerr and Pitango Venture Capital

3) LeapFrog Investments, Sequoia Capital China and Sofina’s $55m venture financing of MedGenome Labs

4) The $50m venture financing of TytoCare by Insight Partners, Olive Tree Ventures and Qualcomm Ventures

5) Euclidean Capital, Frazier Healthcare Partners and Longitude Capital Management Co’s venture financing of Dascena for $50m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Covid-19 slows Fujifilm’s medical imaging expansion

An announcement to investors issued by Fujifilm has revealed that the company’s $1.63bn acquisition of its rival Hitachi’s line of imaging products has been delayed as a result of the Covid-19 crisis. Issued on 28 May, the two-paragraph statement cites “delays in some of the preparations due to the spread of infection” as cause for the postponement in the completion schedule for the transaction.

A new completion date was not provided by Fujifilm, but would be “promptly given as soon as fixed”. Originally, the deal was intended to complete in July 2020, having first been announced in December 2019. The acquisition was expected to boost Fujifilm’s stake in the global medical imaging market, 65% of which is currently dominated by GE, Siemens and Philips

Ally Bridge Group invests in Covid-adjacent med tech

Life science investors at the Ally Bridge Group (ABG) have led three US investments in April 2020 into commercial-stage companies amid the Covid-19 pandemic.

ABG led investments of $25m into Vida Health, $60m into Rapid Micro Biosystems and $66m into Pulmonx. All of the companies operate in the medtech space and have USPs that could become increasingly relevant as the global crisis continues. In a statement, ABG founder and CEO Frank Yu said: “These three new investments highlight ABG’s focus on addressing some of the fundamental healthcare challenges exposed by the Covid-19 pandemic.”

LabMinds secures fresh funds to commercialise REVO robotic system

LabMinds has closed a fully subscribed funding round from a mix of private and strategic investors for the commercial expansion of its REVO robotic system. In addition to the commercialisation of its automation system, the company will use the fund to expand its product portfolio.

Novartis expands ophthalmology pipeline with Amblyotech acquisition

3M relaunches as Kindeva in $650m Altaris acquisition

3M Drug Delivery Systems has rebranded itself as Kindeva Drug Delivery following its acquisition by Altaris Capital Partners, in a transaction valued at $650m.

3M will retain a 17% minority interest in Kindeva alongside Altaris. The sale does not include 3M’s transdermal components business.