Insight: market

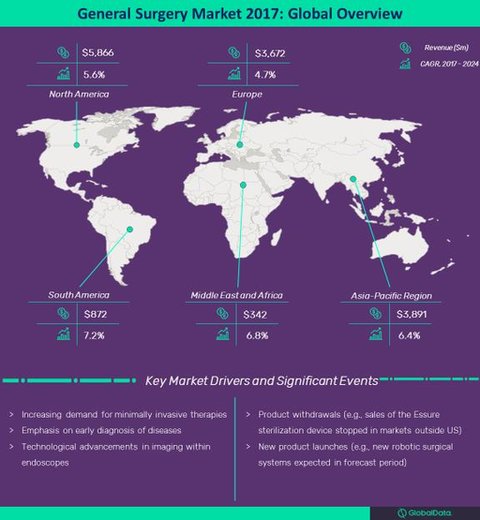

General surgery market overview 2017

Among the different categories of devices, endoscopes currently account for more than half of the general surgery market in terms of market size. In 2017, the market for endoscopy devices was estimated to be $7.6bn and is expected to grow at a CAGR of 7.3% to reach a value of $12.5bn in 2024. The endoscopes market is dominated by different types of scopes used within the gastrointestinal, respiratory, and urology anatomies. Different types of scopes are considered, including non-video and video scopes as well as rigid and flexible scopes.

An increasing demand for minimally invasive therapies coupled with advancements in imaging technology in the field of endoscopes is fuelling the growth of this market. An increasing emphasis on early diagnosis of diseases such as cancer, meanwhile, is fuelling the growth of the biopsy devices market, which is expected to grow at a CAGR of 2.2% from 2017 to 2024. Increasing obesity rates are expected to drive the market for bariatric surgery devices at a CAGR of 9.3% from 2017 to 2024 due to an increasing number of bariatric surgical procedures.

While there are continued regional differences between relative popularity of different bariatric surgical procedures, sleeve gastrectomy is the most popular procedure in most markets and is closely followed by gastric bypass procedures, which are more dominant in countries such as Brazil. Gastric banding will continue to decrease in popularity in most markets.

While the overall general surgery market is expected to grow over the forecast period, there are certain categories of devices that continue to be closely watched for their potential to redefine the market in terms of user uptake, post-operative outcomes, product recalls, or newer products expected to enter the market. One such category is the robotic surgical systems market.

Robotic surgical systems

This market is expected to witness significant growth over the forecast period, with a CAGR of 13.5% from 2017 to 2024 for robotic surgical systems used within general surgery. Benefits offered by robotic surgical systems include a surgical procedure associated with fewer tremors and the feasibility of these systems to conduct a surgical intervention within an anatomy that is hard to reach via conventional laparoscopic or open surgical interventions. However, the robotic surgical systems market also has its fair share of critics who question the economic feasibility of using these systems, given high acquisition costs.

Conducting a higher number of clinical studies to establish the cost effectiveness of these systems may help to minimise the gap between the perceived benefits as seen by industry innovators and healthcare providers. Newer products are expected to enter this market in the forecast period and offer competition to Intuitive Surgical, currently the dominant player in the robotic surgical systems market for general surgery. The female sterilisation market is another category where the halting of sales of one of its most prominent products highlighted the vulnerability of a medical device plagued by safety concerns.

In September 2017, Bayer announced that the Essure sterilisation device will no longer be available for sales outside the US market. Popularity of Essure was attributed to it being the only non-invasive form of permanent birth control in the market. Although the product had seen steady growth since it received an FDA approval in 2002 with increasing number of procedures, the long-term safety concerns of the product weighed against it; the decreasing confidence in the product is expected to contribute to increased sales in alternative products such as laparoscopic sterilization devices. According to GlobalData, the female sterilisation devices market was valued at $195.7m in 2017.

As with most medical devices, those in the general surgery market witnessed price erosion in many countries, and the trend is expected to continue through the forecast period. Increasing budget constraints on healthcare systems, along with a purchasing process that is increasingly becoming more transparent and stakeholder-intensive, is expected to control the costs and effectiveness of the purchasing process and of the devices that come with it. Entry of new surgical products is also expected to open the market to a greater number of companies and offer more choices to healthcare providers.