By January 2026, many medical device factories will still be constrained by legacy processes. Manual inspection, shift changes and human-dependent quality checks limit production line uptime to 70-80%, while errors relating to human tiredness affect 15-20% of small, high-volume components such as catheters and stents. Scrap levels of 10-15% persist, and product changeovers can still take four to eight hours, inefficiencies which are increasingly hard to justify in a cost-sensitive, tightly regulated market.

“Conventional manufacturing loses 20–30% efficiency to visual inspection errors caused by human tiredness,” says Dr Elena Vasquez, Quality Director at Arterex Medical. These limitations have spurred interest in automation models closer to semiconductor manufacturing than traditional life sciences.

Financial pressures are accelerating this shift. The global medical device contract manufacturing market reached $83.8 billion in 2025 and is projected to grow to $140.8 billion by 2030 (CAGR 10.9%). Asia-Pacific leads in production capacity, while Europe and North America are deploying advanced automation to offset 25–40% higher labour costs and support selective reshoring.

Regulatory factors are reinforcing the trend. Under the EU MDR and IVDR, over 90% of manufacturers have transitioned part of their portfolios, often at higher costs and with longer validation cycles. ISO 13485 and US GMP requirements further increase audit, traceability and documentation burdens. In this environment, automation is no longer solely a headcount-reduction tool: it improves reproducibility, strengthens digital traceability and enables faster, more reliable changeovers.

Anatomy of near-dark med-tech manufacturing

In practice, many med-tech manufacturers adopt hybrid or “near-dark” models, combining highly automated lines with human supervision to manage exceptions, complex quality judgements and regulatory compliance. Industrial robots and autonomous guided vehicles (AGVs) or autonomous mobile robots (AMRs) transport components and tooling with no fixed conveyors, while technicians intervene only as needed.

IIoT networks connect sensors, machinery and control systems to enable predictive maintenance, workflow optimisation and full traceability. Remote monitoring from control rooms further enhances productivity. Concepts long used in semiconductors and electronics are now spreading in med-tech, improving quality, reproducibility and changeover times in high-mix, regulated production environments.

According to Georgia Perakis, William F. Pounds Professor of Operations Management at MIT Sloan, workflow automation can significantly improve equipment effectiveness and reduce changeover times in complex manufacturing, although exact med-tech figures are commercially sensitive.

Quality, AI vision and the new validation challenge

Visual inspection and final assembly have traditionally been the weakest links in automated med-tech manufacturing, with manual inspection prone to fatigue and error. Since 2024, AI-driven machine vision has begun closing this gap. These systems achieve anomaly-detection rates exceeding human inspectors, identifying microscopic defects, dimensional deviations and assembly nonconformities in real time, often as adaptive modules integrated into existing lines.

Flextronics in Singapore has deployed near-dark lines for single-use syringes, cutting defects by ~40%. Tecomet in the Netherlands has tripled throughput for orthopaedic implants. “We have achieved 95% uptime on high-volume runs,” explains Tecomet CEO John Riley.

At Zimmer Biomet, an AI inspection pilot reduced inspection time by 70%, with ROI in nine months. At an industry level, the BCG MedTech AI Report (October 2025) shows that overall equipment effectiveness can rise from 75% to more than 90% in high-mix environments. Philips’ Ibex digital pathology solutions increased diagnostic throughput by approximately 37%. More broadly, a Boston Consulting Group report published in September 2025, found that 10%–25% of med-tech and biopharma companies report cost reductions and faster operations following AI adoption.

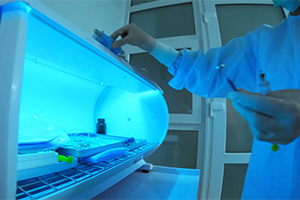

Inside a hospital’s Central Sterile Services Department (CSSD), AI-driven systems and robotics are streamlining sterilisation to enhance patient safety and operational efficiency. Credit: LENblR via Getty Images

As of October 2025, adoption of AI and robotics in sterile processing is estimated at 5–15 percent of CSSDs worldwide. Hospitals using AI-driven systems report sterilisation cycle turnaround times reduced by up to 35 percent.

AI also improves predictive maintenance. Systems continuously monitor washers, sterilisers, and other equipment, anticipating breakdowns and scheduling repairs. According to Sterigene (France), AI-based maintenance can reduce spare parts costs by 15 percent and cut both typical repair time and mean time between failures by roughly 25 percent.

Labour, skills and supply chain resilience

Automation is reshaping the workforce. Cobots perform repetitive tasks, freeing up skilled employees for complex operations. Outside med-tech, in high-precision sectors such as plastics, injection moulding and glass forming, Konica Minolta reports 25–400% productivity gains from using cobots.

Standardised, robot-ready processes enhance supply chain resilience: multi-regional “copy-exact” plants can rapidly absorb production volumes during disruptions. Digital twins and real-time IIoT monitoring allow proactive responses, improving operational continuity by days to weeks.

Automation also impacts product safety. A study in JAMA Health Forum found that of 950 FDA-cleared AI-enabled devices, 60 were linked to 182 recalls, mainly due to diagnostic or measurement errors. Deloitte’s 2025 Life Sciences Regulatory Outlook emphasises that AI adoption requires continuous risk monitoring and regulatory compliance to maintain both efficiency and safety.

Emerging vulnerabilities and regulatory challenges in 2026

As med-tech production becomes more digitised, reliance on software, cloud platforms and vendor firmware introduces cybersecurity and obsolescence risks. The OECD notes that interconnected digital systems, while essential for efficiency, expose supply chains to cascading failures if a single cloud provider is compromised.

Risk management experts stress that IIoT, cloud computing and intelligent automation improve operational performance but expand the attack surface. Marsh, a global insurance and risk specialist, warns that as supply chains digitise, cyber actors exploit new vulnerabilities, making continuous monitoring and robust cybersecurity essential.

Regulators face a central challenge: validating, auditing and documenting AI-driven inspection systems. Next-generation plants must demonstrate that models remain controlled, traceable, and compliant throughout their lifecycle, ensuring both patient safety and regulatory adherence

Med-tech contract makers chase automation edge

Contract manufacturers are leading med-tech's automation drive. Specialist firms deploy flexible, robot-heavy lines for multiple OEM programmes, featuring rapid changeovers, integrated manufacturing execution systems (MES) and full digital traceability. Smaller device makers facing European MDR and IVDR costs rely on these partners to sustain CE-marked stocks without leaving production idle.

Leaders in Asia and Europe are piloting near-dark production lines for single-use devices and implants, as OEMs reshore into automated micro-factories.

Asia

India's “"Make in India” leaders, such as Tulip and Maxima, produce diagnostics at 30% lower cost using robot assembly and MES quality controls. China's Foxconn and Flex production sites manufacture high-volume disposables under 24/7 AI supervision, with MES integration slashing lead times by 40% while meeting ISO 13485. Singapore's AEM Holdings is boosting production of implant components by 25% using cobots linked to MES and quality systems.

Europe

Tecomet (Netherlands) operates near-dark lines for implants and single-use orthopaedic tools, hitting 95% uptime and triple throughput with cobots and MES. Plexus (Germany) runs robot-flexible lines for catheters and syringes, with MES ensuring MDR-compliant changeovers. Fraunhofer IPK's small-batch set-ups for custom devices is cutting lead times by 50% thanks to 3D-integrated cobots and MES [ipk.fraunhofer]. Thermo Fisher production sites process 400,000 litres of IVD filling daily thanks to MES-connected automation. GE Healthcare reshored disposables to Plexus micro-factories, halving labour costs. "Quality 4.0 is creating the factory of the future, where digital technologies boost productivity, flexibility and quality across the supply chain via real-time monitoring and predictive analytics”, states a BCG report based on a survey of 221 companies including med-tech and pharma firms.

Dr. David W. Bates, Chief of General Internal Medicine at Brigham and Women’s Hospital

Predictive analytics is no longer a theoretical concept, it is becoming a practical tool which allows hospitals to anticipate equipment breakdowns before they occur, ultimately protecting patients and saving costs.

Dyke Ferber, clinician scientist at the Else Kröner Fresenius Center for Digital Health

Caption. Credit:

Total annual production

Australia could be one of the main beneficiaries of this dramatic increase in demand, where private companies and local governments alike are eager to expand the country’s nascent rare earths production. In 2021, Australia produced the fourth-most rare earths in the world. It’s total annual production of 19,958 tonnes remains significantly less than the mammoth 152,407 tonnes produced by China, but a dramatic improvement over the 1,995 tonnes produced domestically in 2011.

The dominance of China in the rare earths space has also encouraged other countries, notably the US, to look further afield for rare earth deposits to diversify their supply of the increasingly vital minerals. With the US eager to ringfence rare earth production within its allies as part of the Inflation Reduction Act, including potentially allowing the Department of Defense to invest in Australian rare earths, there could be an unexpected windfall for Australian rare earths producers.