Devices

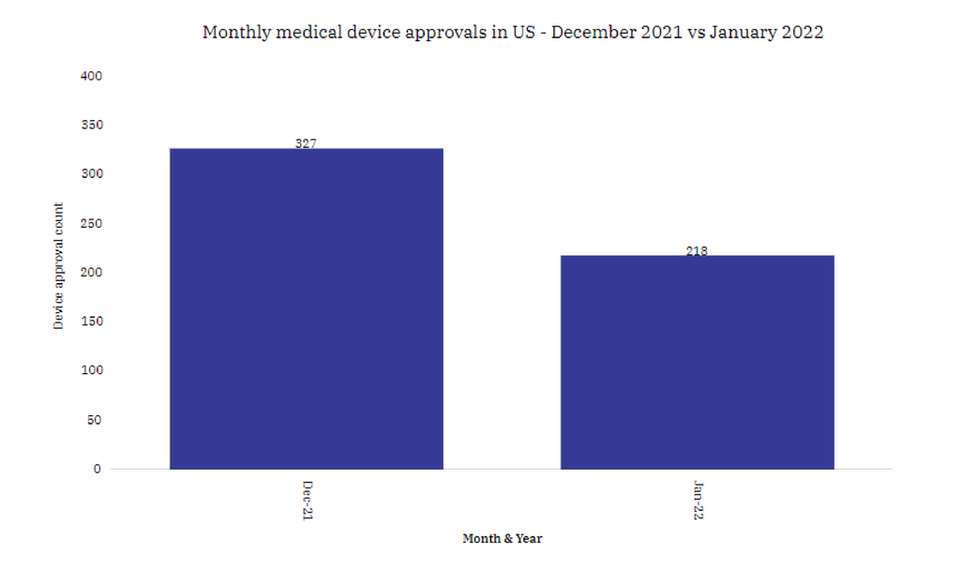

January 2022 saw a 33% drop in medical devices’ approval in the US

The number of medical devices gaining approval in the US in January 2022 saw a 33% decrease when compared with December 2022, according to GlobalData’s marketed products database.

Powered by

The US medical devices market was worth $180.96bn in 2021 and is expected to reach $182.95bn by 2023, according to GlobalData’s analysis.

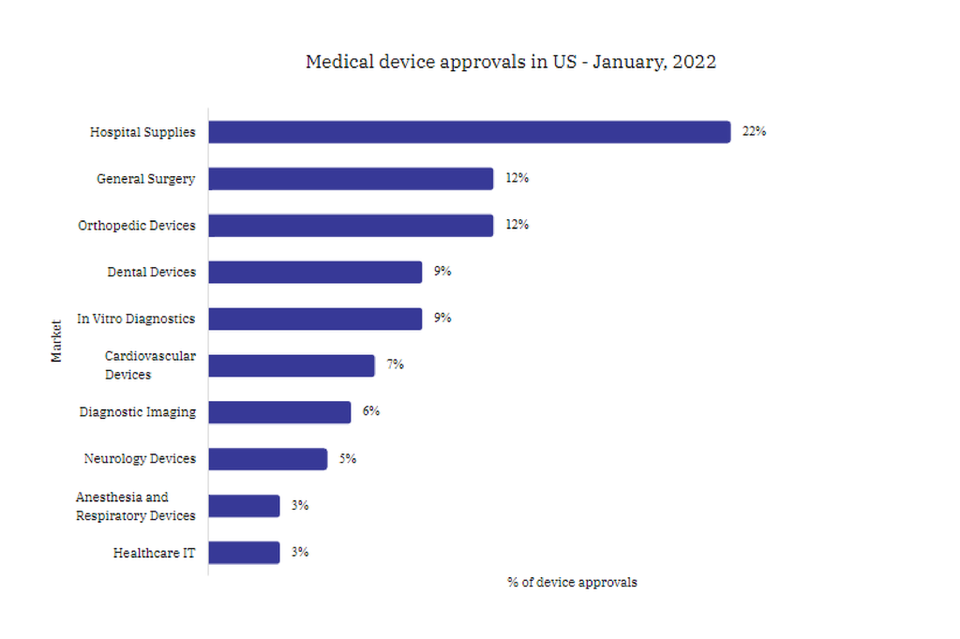

Hospital Supplies led newly approved devices in January 2022

Looking at the device sectors, Hospital Supplies held the largest share of 22% in gaining US approval during January 2022, followed by Orthopedic Devices with 12% and General Surgery with 12%.

As for the US medical devices market value, the Hospital Supplies market held a 13% share worth $22bn in 2021 and is expected to reach $21.94bn by 2023.

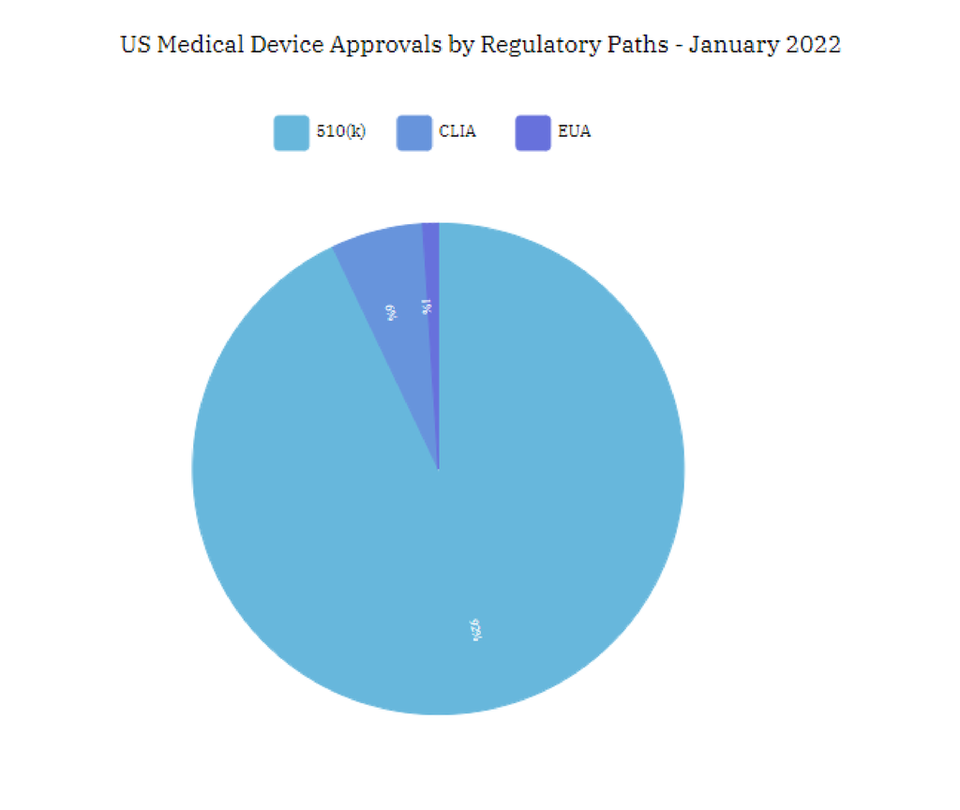

510(k) approved medical devices dominate the US market

In January 2022, the number of new medical devices entering the US market saw a 33% decrease when compared with December 2021.

GlobalData’s database indicated that 510(k) approved medical devices entering the US market, accounted for 92% of new medical devices in January 2022, compared with 95% in the previous month.

CLIA inclined by 550% in January 2022, as against 1% in December 2021. CLIA have become more common during the COVID-19 pandemic, as a speedy mechanism to bring therapeutic devices to market more quickly than the usual device approval process.

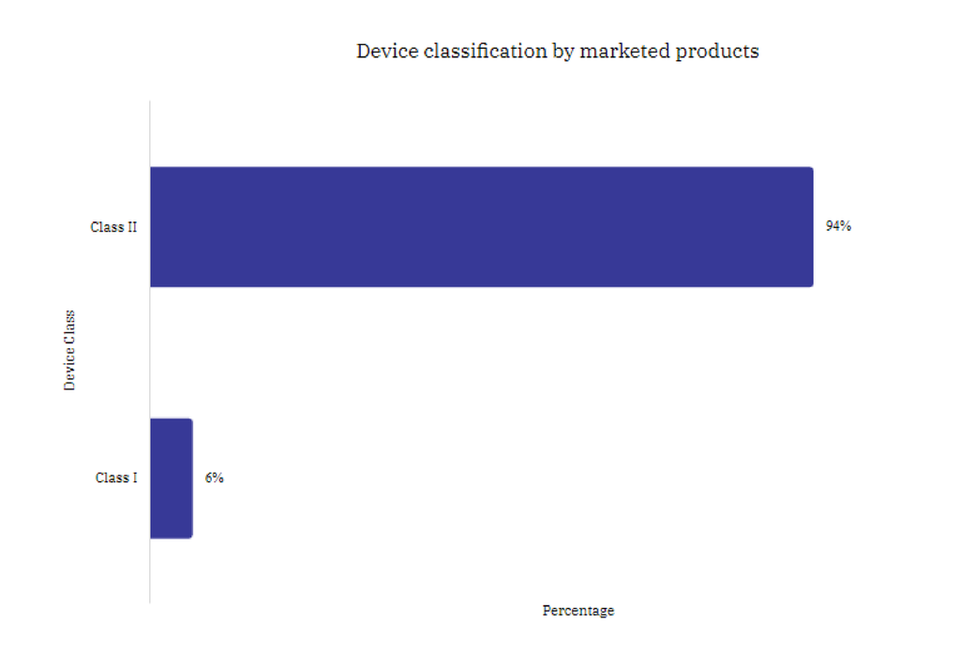

Class II devices dominated the US marketing activity for new medical devices in January 2022

During January 2022, Class II medical devices entering the market accounted for 94% of new medical devices approved in January 2022, compared with 85% in December 2021. Class I devices decreased from 13% of new device approvals in December 2021 to 6% in January 2022.

Hospital Supplies constituted the largest group of Class II devices, accounting for 16% of devices. Class III devices are devices that generally pose the most risk to patients and includes implantable devices. Class I devices are of a lesser risk.

Company-developed devices lead US regulatory approvals during January 2022

Looking at the share of activity among medical device organisations, GlobalData’s database indicated that company-developed devices accounted for a 98% share of newly approved devices in the US during January 2022, while institute-developed marketed products held the remaining share.

In comparison, December 2021 saw a split of 95% in newly approved devices originating from private and public companies and 5% from institutes.

Methodology

The medical devices approval data used in this article were extracted from Medical Marketed Products Database of GlobalData’s Medical Intelligence Center. Marketed Products database covers all commercialized medical devices which are intended for diagnosis, treatment, and management of diseases/conditions/symptoms directly or indirectly. Marketed products are covered from regulatory bodies like US FDA, company websites, news releases, SEC filings etc. The information is collected by following systematic research techniques and proprietary methodology.