Feature

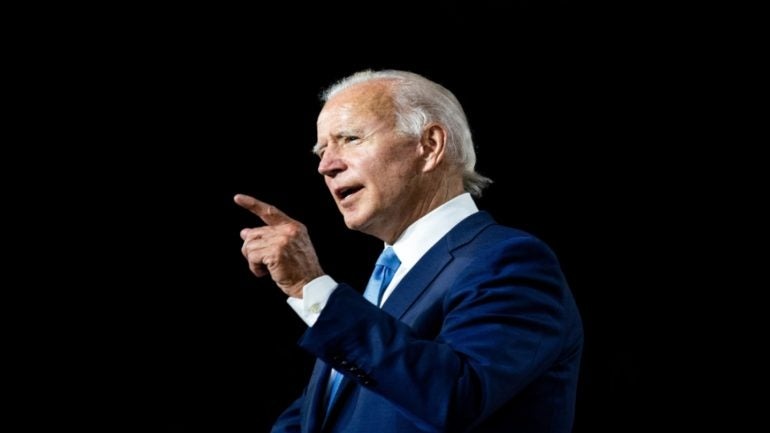

Explainer: US Election 2024 -Biden’s healthcare outlook

As the 2024 US Election begins to pick up steam, the Biden administration is already trying to remind voters of past success while challenging healthcare pricing. By Joshua Silverwood.

A poll conducted by US broadcaster CNBC found that 77% of respondents considered healthcare to be one of their top issues. Credit: Shutterstock / Luca Perra

As a presidential election looms in the US, the incumbent democratic party has made strides to win over public, party and investor confidence through small reforms to healthcare.

Current US president and soon-to-be electoral candidate, Joe Biden, is expected to lean on his historic experience of legislating healthcare as one of the key talking points on an upcoming campaign trail, especially given a recent poll conducted by analytics company Gallup found that 51% of Americans care ‘a great deal’ about the availability and affordability of healthcare. It also highlighted how the issue is of prime importance to Democrat voters versus the alternative Republican Party voters – with Democrat voters caring more about the affordability of healthcare by a 17-point margin.

A separate poll conducted by US broadcaster CNBC found that 77% of respondents considered healthcare to be one of their top issues, with 50% saying they believed that Biden would do better when it came to healthcare over his Republican competitor Donald Trump. Only 31% of those polled believed that Trump would do a better job.

As a result, it is no wonder that in the upcoming election, the US Democratic Party will seek to push reforms and lean on past successes, with the overall healthcare market set to bear the brunt of the changes.

Today, over 100 million Americans have coverage through either Marketplace or Medicaid, thanks (in part) to increased affordability thanks to the Inflation Reduction Act.

Centers for Medicare & Medicaid Services (CMS) administrator Chiquita Brooks-LaSure

Medical Device Network examines how the US Democratic Party and Joe Biden plan to win voters over ahead of a hotly contested election, examining past healthcare policy and how it has affected the industry, as well as some of the proposed changes set to hit the industry should Biden get another term in office.

The Biden Administration has already begun reminding voters of its candidate’s previous track record. 22 March 2024 marked ten years since the introduction of the Affordable Care Act (ACA). Introduced under the Obama administration in 2014, the highly controversial and heavily embattled bill sought to reform the US healthcare insurance market, a system through which the vast majority of Americans will interact with any form of healthcare.

Key to the act were provisions that were that insurers would be forced to accept all customers and offer them the same rate regardless of pre-existing conditions or demographic status. At the same time, it also sought to vastly expand the coverage of the country’s socially run Medicare and Medicaid options by expanding the criteria of who is eligible.

According to a statement published by the US Department of Health and Human Services (DHHS) published in March 2024, since its introduction in 2014, the ACA has seen 18.6 million people enrolled in some form of healthcare coverage with a total of 45 million Americans enrolled in coverage related to the ACA.

Commenting on the ten years since the introduction of the somewhat Biden-adjacent bill, HHS Secretary Xavier Becerra said: “Thanks to President Biden’s leadership, more than 21 million Americans have health insurance through the Affordable Care Act Marketplaces, an all-time high, with millions of families saving hundreds of dollars every month.”

Centers for Medicare & Medicaid Services (CMS) administrator Chiquita Brooks-LaSure said: “Gone are the days when being a woman was considered a pre-existing condition or sick children could be denied health insurance. Today, over 100 million Americans have coverage through either Marketplace or Medicaid, thanks (in part) to increased affordability thanks to the Inflation Reduction Act.”

Many pharmaceutical companies’ main point of contention is the Inflation Reduction Act. Credit: Shutterstock / Valeri Luzina

The Inflation Reduction Act (IRA) itself has been the source of some concern, especially among pharmaceutical and medical device manufacturers as its 2026 effect date draws closer. Introduced in 2022, the IRA was designed to allow the Medicare system to negotiate prices and rebates for certain drugs from drugmakers, a policy that has drawn criticism from the industry primarily for its perceived knock-on effect on research and development.

Comprised of two timelines, one for large (biologics) and small molecule therapeutics, in which Biologics can be selected for price negotiation 11 years after approval, with the price enacted 13 years post-approval. This policy was intended to stem the rate at which the price of medicines can inflate over time, to lower the cost for the average supplier and buyer of these drugs. A reduction in drug prices at the patient’s end will translate into an overall positive perception of the current Joe Biden administration but the move may have won the administration no confidence from the industry or investors.

Research by GlobalData found that currently there are 607 venture-backed companies headquartered in the US that are being affected by a reported downturn in biotech funding with more than 1,500 drugs at stake. Approximately a third have not raised any capital in the past three years.

On the horizon

As part of its 2024 manifesto on healthcare, the Democratic party has set out a broad spectrum of objectives when it comes to reforming aspects of the US healthcare system despite presently being the party in power. Among some of those commitments is support for increasing funding for research into health disparities by race, ethnicity, gender, gender identity, sexual orientation, age, geographic area, and socioeconomic status, with a particular focus on how the social determinants of health contribute to differences in health outcomes.

The manifesto reads: “We will increase the federal investment in research and development for new medications through the NIH, and make sure that there is a return on that investment for taxpayers. We will also build on the foundation of the Obama-Biden Administration’s Cancer Moonshot to break down silos and accelerate research into cancer and cancer treatments by creating an agency with the sole mission of finding new cures and treatments for cancer and other diseases.”

It comes as the FDA Center for Drug Evaluation and Research (CDER) released the 2023 drug trials snapshots (DTS) summary report, which called for a greater need for diversity among clinical trial cohorts to produce much more reliable results.

However, the diversification of clinical trials is not a primary public-facing issue, whilst it may play into an element of Biden and the Democrat party’s healthcare strategy it is unlikely to make up a large part of Biden’s healthcare focus, that is likely to be shared between the dual issue of drug pricing and the legal maintenance of reproductive rights.

When it comes to reproductive rights, both the president and the democrats are in step on this issue, looking to use existing legislature and state legislature to ensure that access to abortion and parental services remain available for those who need it. The mounting pressure follows after the state of Alabama introduced sweeping changes to its state laws in a bid to greater restrict access to abortion, which in turn accidentally saw in-vitro fertilisation banned on the same merit.

However, Biden steps away from his colleagues in the Democratic party when it comes to the issue of regulating the pricing and inflation of drug prices. Writing in a statement from the White House on 6 March of this year, the president similarly set out a series of proposals to reform the pricing of drugs with a scope beyond 2024.

Some of these suggestions include initiatives such as allowing Medicare to negotiate the price of at least 50 drugs per year as opposed to the current system that only allows for the prices of 20 drugs to be contested. Another involves expanding the cap on out-of-pocket prescription drug costs, imposing a $2,000 cap on prescription prices for all Americans, not just those on federal healthcare systems such as Medicare and Medicaid.

Additionally, the list of initiatives calls for further expansion of the IRA Requirement that Drug Companies Pay Rebates When They Increase Prices Faster than Inflation. The statement reads: “Thanks to the IRA, drug manufacturers must now pay rebates to Medicare if their price increases for certain drugs exceed inflation. The President is calling on Congress to require those rebates for commercial drug sales, as well as sales to Medicare. That will save the federal government billions of dollars, further curb prescription drug price inflation, and reduce health insurance premiums for people with private health insurance coverage.”

In the two-party US electoral system, the Democratic party and, by extension, Joe Biden, is the only party running on any form of greater healthcare regulation or large-scale reform. Their competitors on the Republican side are still calling for the full repeal of the ACA after previously unsuccessful attempts to remove it under Trump. Despite this, the Republican party is still advocating for its removal. This leaves the typical US voter conscious of healthcare with only one viable option.

However, it remains to be seen how effective many of Biden’s and the current Democratic party initiatives on healthcare will be for both voters and the industry.

Outside pressures

No US election would be complete without a myriad of interest and pressure groups leaning on either party with their own set of aims. In the case of the US pharmaceutical and clinical trials market, groups such as the Biotech Industry Organization (BIO) are not pleased with the recent IRA, arguing that it vastly impacts the competitive nature of their industry, with long-term implications incentivising shareholders and investors to move their investments away to much more profitable drugs where the government is unable to set prices.

As a result, the issue has taken the top spot at many healthcare and industry group conferences over the past half-year since the bill was proposed, from the American Society of Clinical Oncology (ASCO), Clinical Trials in Rare Diseases conference, to BIO’s conference, strategising on how to call on the Biden administration to take a step back in terms of pricing has been at the forefront.

The IRA has been so controversial among life science pressure groups that it has been the subject of multiple lawsuits, brought against the DHHS by pharmaceutical giants including AstraZeneca and Johnson & Johnson, the manufacturers of Xarelto (rivaroxaban) and Farxiga (dapagliflozin), two drugs subject to the new rule that would allow the CMS to negotiate prices.

In the two-party US electoral system, the Democratic party and, by extension, Joe Biden, is the only party running on any form of greater healthcare regulation or large-scale reform.

Meanwhile, pressure groups and CROs have produced their own research claiming that the IRA will only benefit a small percentage of the US populace, with its direct effect on market competition outweighing its potential benefit to the consumer. Research published in the Journal of Oncology Practice found that by the metrics of the IRA’s wording, very few oncology and cancer drugs would fall into the new pricing negotiation scheme, finding that only 2.2% of beneficiaries with cancer will see lower costs because of the IRA negotiations. The main reason is that while novel cancer drug treatments are priced high, they generally treat relatively few beneficiaries and thus do not meet negotiation eligibility criteria, which are primarily based on a ranking of total spending.

However, not all segments of the industry are displeased with the Biden administration’s current policy agenda. One foreign trade policy that has been met with significant applaud in the US was the decision to significantly raise the trade tariffs on computer chips and medical products in a bid to stem the flow of Chinese goods, often produced at cheaper cost, undercutting the US market domestically, passed on 14 May.

Shortly before this, the administration passed what it called the CHIPS and Science Act, which set out a $125bn fund, provided in part by US-based computing giant Micron Technology, to construct two brand new fabrication facilities in New York and Idaho.

The hike in tariffs within the medical space is intended largely to target cheaply produced medical items such as syringes and personal protective equipment, but its provision targeting Chinese-produced computer chips has been met with some tentative celebration. Traditionally the vast majority of the world’s computer chips and semiconductors, used in all forms of electronic devices at all levels, have been produced in China at a fraction of the cost that they would traditionally have been produced in the US, incentivising imports of the goods.

Previously, earlier this year, the Advanced Medical Technology Association (AdvaMed) called on Biden to shore up the US medical device manufacturing scene as more and more jobs move abroad. The call followed after several job cuts at facilities in states such as New Jersey as medtech companies look to migrate to countries such as Ireland.

Many private companies will likely seek to affect the outcome of the election through donations to Political Action Committees (PACs). Credit: Shutterstock / mdgn

Now, AdvaMed is applauding the Biden Administration’s attempts to “strengthen supply chains and protect patients”. Commenting on the investment announcement, Advamed president and CEO Scott Whitaker said: “The pandemic, extreme weather events, and geopolitical unrest have revealed severe supply chain challenges that have disrupted healthcare, as medtech companies work to source and transport components, parts, raw materials, and key inputs for medical devices. AdvaMed and our member companies are working closely with the Administration and Congress to address these challenges and strengthen the supply chain resilience in order to protect patients.

“[This] announcement by President Biden is a major milestone in the whole-of-government approach we have championed through our role in the Administration’s Joint Supply Chain Resilience Working Group and with FDA’s Supply Chain Resilience Program.”

To raise confidence in his ongoing bid for the 2024 presidency and his final term, Biden will need to win over the confidence of the majority of healthcare stakeholders in much the same manner that his predecessor Obama was forced to cooperate with stakeholders when he sought to secure his second term in the wake of the ACA.

Regardless, it remains to be seen how these attitudes towards Biden will play out when it comes to electoral funding. In the US, many companies are likely to pay into what is called Political Action Committees (PACs), which are financial groups set up as a means of gathering contributions from donors to be then passed into electoral campaigns and advertising for its preferred candidate. Through these mechanisms, private entities in the US can provide funding and support to potential candidates to affect their preferred outcome.

While healthcare-related PACs have favoured the Democrats in the past, the margins have been small, with the party receiving an estimated $24m from PACs between 2021 and 2022. Meanwhile, the Republican party received $23m in funding. This fine margin could spell influential defeat in the US for a Biden administration running on a thin margin

Medtronic offers a comprehensive RPM platform called CareLink which helps physicians, patients and carers manage health metrics and medical adherence. It has proved particularly useful in the management of diabetes. Real-time data is sent to CareLink via various devices and monitors, and patients can connect with their care team.

Accuhealth is leading on smart Bluetooth devices including blood pressure monitors, a glucose sensor, oximeter, sleep and resting heart monitor, and more. The company also offers a range of remote patient monetary vendor tools and focuses on international outreach with many of its digital technologies available in multiple languages.

Boston Scientific’s LATITUDE is a popular home monitoring system that provides doctors with access to healthcare data from certain cardiac implants such as pacemakers and defibrillators. The technology can detect the tiniest of changes in cardiac function and immediately warn the patient and clinician of impending heart failure

“Major players in the wearable technology market, such as Sony, Apple, Samsung Electronics, Xiaomi, Huawei, Garmin, among others, are also expected to drive growth in the global wearable tech market,” predicts Garcia. “Their proficiency in developing innovative wearable technology together with the incorporation of AI capabilities puts them in a strong position to take advantage of the growth in the RPM market.”

Key players include Medtronic, Accuhealth and Boston Scientific

says Elia Garcia, a GlobalData analyst

Caption: The US Pentagon is seeking to reduce carbon emissions through a range of programmes, but will it go far enough? Credit: US DoD

Total annual production

$345m: Lynas Rare Earth's planned investment into Mount Weld.

Caption. Credit:

Phillip Day. Credit: Scotgold Resources