Industry views

38% of companies lack an ESG strategy – GlobalData survey

A new survey has found that over half of B2B respondents believe that “for most companies, ESG is just a marketing exercise”. Eve Thomas reports.

Well over a third (38%) of companies do not have an ESG strategy, and half (50%) of respondents believe that “for most companies, ESG is just a marketing exercise”, according to a new survey.

The ESG Sentiment Polls Q1 2024 survey asked 360 respondents about the presence of ESG strategies in companies, as well as the reasons behind them and other disruptive factors impacting businesses.

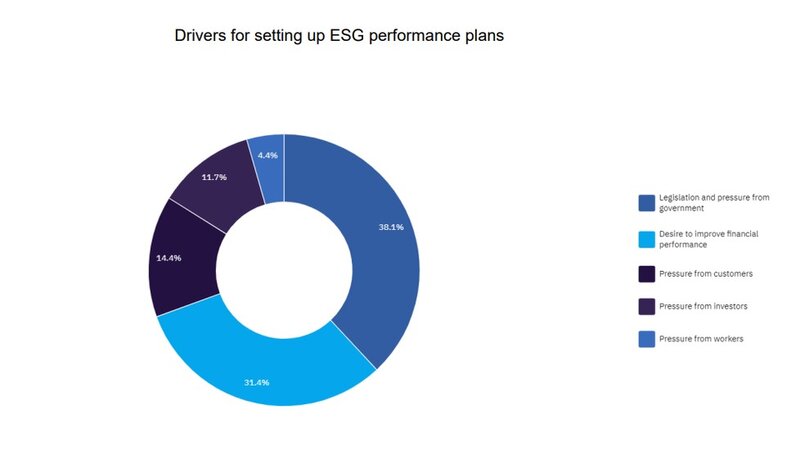

It found that legislation and pressure from governments are perceived by 38% of respondents to be the primary factor behind ESG strategies, while 32% feel that the desire to improve financial performance is the key reason.

This is in stark contrast to pressure from workers, which only 4% of survey respondents consider to be the main reason behind ESG strategies. Customers are perceived to be more influential, with 14% of respondents believing to be the primary factor.

The results are buttressed by the sentiment that ESG strategies are primarily “just a marketing exercise” – a view shared by over half of the survey respondents. Nearly a third (32%) feel that the picture was more mixed, expressing a view that some companies’ ESG strategies are meaningful, while others are a marketing strategy. Only 8% feel that most businesses are committed to ESG.

Concerns about the authenticity of ESG have prompted increased scrutiny. GlobalData’s recent ESG 2.0 report noted that: “Companies now have to be careful about their communications and strategy on ESG. Regulators are increasingly keen to scrutinize them, politicians might single them out, and stakeholders are demanding action to meet ESG commitments.”

It considers this new era of regulatory action to be the second phase of ESG, which it defines as a transition away from voluntary strategies and towards mandatory ones.

Despite this, only 9% of survey respondents consider ESG to be the theme most likely to impact their businesses over the next 12 months. This made it the least popular theme of the options provided, with high inflation and geopolitical conflict expected to be the two most impactful.

Underestimating the importance of ESG strategies will prove detrimental to businesses in the long term. The report warns that: “ESG 2.0 will be less forgiving of poor ESG performers, especially on environmental issues,” adding that: “Companies that fall behind on decarbonization will pay higher costs and lose sales” and “will be held accountable for ESG performance across their value chain, not just their own operations.”