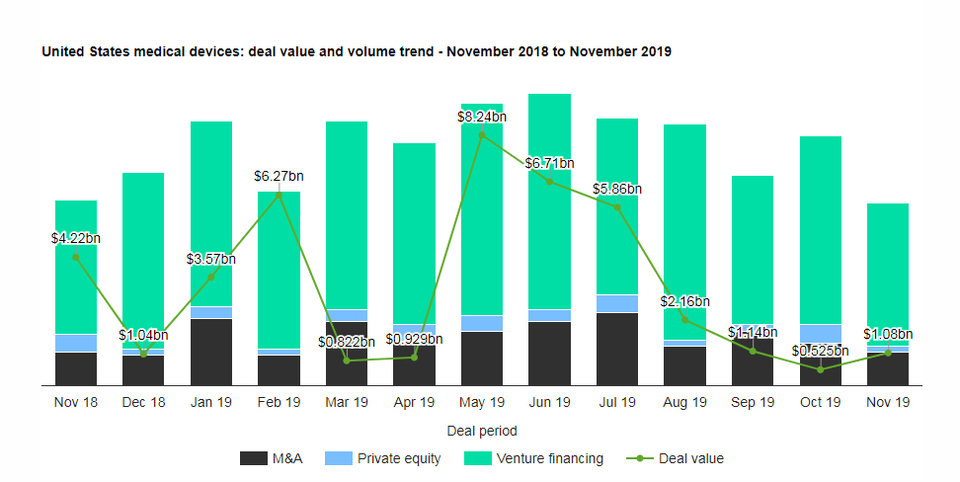

US medical devices industry sees a drop of 25% in deal activity in November 2019

A total of 60 deals worth $1.08bn were announced in November 2019, compared to the 12-month average of 80 deals.

Venture financing was the leading category in the month in terms of volume with 47 deals which accounted for 78.3% of all deals.

In second place was M&A with 11 deals, followed by private equity with two transactions, respectively accounting for 18.3% and 3.3% of overall deal activity in the country’s medical devices industry during the month.

In terms of value of deals, M&A was the leading deal category in the US medical devices industry with total deals worth $502.01m, while private equity and venture financing deals totalled $370.75m and $205m, respectively.

US medical devices industry deals in November 2019: Top deals

The top five medical devices industry deals accounted for 61.1% of the overall value during November 2019. The combined value of the top five medical devices deals stood at $658.5m, against the overall value of $1.08bn recorded for the month.

The top five medical devices industry deals of November 2019 tracked by GlobalData were:

1) Clayton, Dubilier & Rice’s $205m private equity deal with Cynosure

2) The $187m acquisition of Plastique and Thermoform Engineered Quality by Sonoco Products

3) Dare Bioscience’s $101.5m acquisition of Keratin Biosciences

4) The $90m venture financing of GenapSys by Foresite Capital Management

5) ICU Medical’s acquisition of Pursuit Vascular for $75m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Medical devices industry M&A deals in November 2019 total $5.78bn globally

The value marked an increase of 4140.4% over the previous month and a rise of 53.1% when compared with the last 12-month average, which stood at $3.77bn. Comparing deals value in different regions of the globe, Europe held the top position, with total announced deals in the period worth $5.4bn. At the country level, The Netherlands topped the list in terms of deal value at $5.4bn.

In terms of volumes, North America emerged as the top region for medical devices industry M&A deals globally, followed by Europe and then Asia-Pacific. The top country in terms of M&A deals activity in November 2019 was the US with 11 deals, followed by Switzerland with four and The Netherlands with two.

Medical devices industry venture financing deals in November 2019 total $964.45m globally

The value marked an increase of 63.1% over the previous month and a rise of 23.9% when compared with the last 12-month average, which stood at $778.69m.

Comparing deals value in different regions of the globe, North America held the top position, with total announced deals in the period worth $516.24m. At the country level, the US topped the list in terms of deal value at $502.01m.

AdaptHealth acquires McKesson’s Patient Care Solutions business

US-based home medical equipment provider AdaptHealth has acquired the Patient Care Solutions (PCS) business of McKesson. The acquisition of PCS business adds urological and ostomy products to AdaptHealth’s home medical equipment (HME) product portfolio.

Medtronic acquires digital health startup Klue

Fujifilm reportedly planning to acquire Hitachi’s imaging business

Japanese photography and imaging company Fujifilm Holdings is reportedly planning to acquire the medical equipment business of Hitachi.

Citing people familiar with the developments, Nikkei Asian Review reported that the deal could be valued at up to $1.55bn.