Interview

The impact of bio‑convergence in healthcare

Biomed Israel 2025: the 23rd National Life Science & Technology Week took place in Tel Aviv, between 20 and 22 May. By Ross Law.

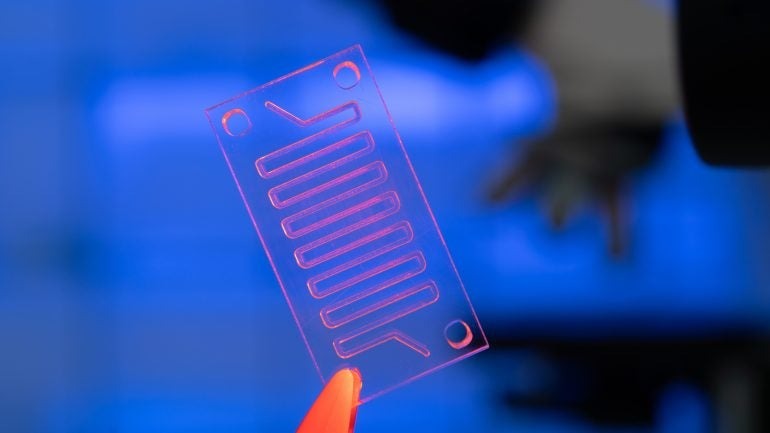

Bio-chips hold great potential to evolve healthcare areas such as home-testing and personalised medicine. Credit: Wladamir Bulgar / SCcience Photo Library / Getty Images

Bio-chips hold great potential to evolve healthcare areas such as home-testing and personalised medicine. Credit: Wladamir Bulgar / SCcience Photo Library / Getty Images

In 2024, the Israel Innovation Authority (IIA) unveiled plans to invest $35m into its first laboratory focused on advancing the field of bio-convergence.

The initiative underscores the country’s intent to become a global leader in this field. Bio-chips and bio-devices are advancing personalised medicine, home diagnostics, and real-time disease detection in healthcare.

By cutting out centralised labs, the technology holds the promise of expediting testing and diagnosis in areas such as infectious diseases and cancer, and in determining how an individual is liable to respond to a given therapeutic or antibiotic-related treatment approach.

At Biomed Israel 2025: the 23rd National Life Science & Technology Week, taking place in Tel Aviv between 20 and 22 May, Dr Shai Melcer, head of the national bio-convergence programme at the IIA, will moderate a panel session titled ‘Frontiers in Bio-Chip and Bio-Devices: Advancing Technological Systems with Cutting-Edge Biology’.

The session will feature keynote addresses from academics, including Hebrew University of Jerusalem professor Yaakov (Kobi) Nahmias, and presentations from Israeli companies involved in the bio-chip and device space such as Teracyte, Pre-Cure, and Nanosynex.

Medical Device Network sat down with Dr Melcer to learn more about the evolving role of bio-chips and devices in healthcare and the role that the IIA is playing in nurturing the advancement of Israeli companies active in the field.

Ross Law: What role does the IIA play in supporting Israel’s bio-chip and device ecosystem in healthcare?

Shai Melcer: The IIA looks at different aspects of development, with several divisions dealing with the lifespan of a startup, the knowledge transfer and commercialisation from academia and other sources through the use of R&D infrastructure, the building of proper teams, launching startups, and funding those startups from pre-seed funding through to Series A.

In essence, the IIA ensures that these companies have the right conditions needed for their growth.

Ross Law: Tell me more about the IIA’s National Bio-Convergence Programme.

Shai Melcer: The National Bio-Convergence Programme was authorised several years ago. While it is led by the IIA, it is actually fostered by several government partners, including the Ministry for Science & Technology and the Ministry of Finance.

The programme looks at different aspects of the bio-convergence ecosystem, specifically multi-disciplinary R&D, academic research excellence, and facilitates matters such as the streamlining of regulatory pathways and the building out of human capital required for this industry.

Ross Law: What is bio-convergence?

Shai Melcer: Bio-convergence relates to technologies that combine biology with either engineering or computational science. Bio-chips and bio-devices are specific products developed using hardcore engineering elements such as micro-fluidic chips or multi-sensor agents combined with biological substances.

Bio-chips are being combined with human biological materials such as tissue organs, cells, and human secretions. The advantage of combining micro-electronics, micro-fluidics and biological tissues is the synergies between the two elements. Specifically in healthcare, these technologies enable extremely small volume samples to be taken and analysed at a high throughput.

Ross Law: How do these technologies apply to healthcare?

Shai Melcer: The ten companies presenting during the session I am moderating can be roughly broken down into three group types.

First, there are those such as Pre-Cure, hardcore bio-chip developers involved in taking samples from a tumour biopsy, placing them on a bio-chip, and growing them for a certain period to maintain the tissue and test it under different therapeutic conditions. If an oncologist has diagnosed someone with cancer and knows that it is a specific type of cancer, which could be faced with more than one line of therapy, they will wonder which line of therapy is the best to use. The only thing they can do, in the absence of specific information pointing out the advantages of one line, is to try one based on, say, genetic background. They’ll try that line, and if it doesn’t work, they’ll stop that therapy and start another therapy.

Every stop-start cycle of testing is measured in months. This is very expensive, has a high morbidity rate for patients, and ultimately reduces the ability for a patient to recover from their cancer.

If you have lines of therapy one through four, and line two is the right line, but you tried line one first, it amounts to wasted time, and line two will not work as well as it could have if it were line one. Therefore, prioritising lines of therapy according to personalised medicine data raises the chances of success of that therapy.

Another subset of companies that will be at the conference are those developing solutions for processes traditionally performed by a centralised lab. But if you use bio-chip technologies, you miniaturise the sample volume required and automate the process of diagnostics being used on a sample. And instead of doing it by way of a centralised lab, it can be done at the point of care.

For example, an individual may walk into the ER and be suspected of carrying a superbug that is resistant to most antibiotics. That is very important to know, because this individual will be a very dangerous patient, and they need to be treated with specific antibiotic regimes or other types of therapy as soon as possible.

Several companies today are using bio-chips to take samples from a patient and rapidly decide whether or not their infection is resistant to antibiotics, and if so, to which antibiotics it’s resistant. This information can be determined through small-volume, high-precision diagnostics, all in a bio-chip arena. So that’s one example where you’re doing point of care work, where you used to send samples to a centralised lab, and it would take too long to get an answer in high-priority situations such as this.

The third type of company that will be at Biomed is those taking any sort of diagnostic that would be performed in a medical healthcare environment, and sending it home. If you take a bio-chip and design it in a way that it could be easily used by the layman, it can be turned into a home diagnostic kit. Even genetic testing could be developed in this way. And some of the companies that will be presenting in the panel are doing just that. And if you can do genetic testing, you can also do protein-based testing. Effectively, if you design a bio-chip properly, you can wrap it up in a kit, send it home, give very simple instructions to people on how to use it, and then the data coming out of that chip could be sent to a health provider for them to advise on the next best steps.

These three groups of presenting companies at this year’s conference stand as good examples of how healthcare could be pushed forward with bio-chip technologies. For this reason, the panel I’m moderating will also not only include companies but also feature research experts from different universities around Israel that are pushing forward on bio-chip and bio-device scientific research.

My panel session also features a representative of a newly announced national lab for bio-chips and bio-devices, which is essentially a service lab designed to provide up and coming companies that have new bio-chip and bio-device development to get them the infrastructure and the know-how they need in how to turn their ideas into a product with the least amount of hurdles as possible.

GlobalData’s business fundamentals senior analyst Ophelia Chan says: “Oncology continued to dominate as the leading therapeutic area for IPOs this year, highlighted by CG Oncology’s $437m upsized IPO—the largest and first of the year. The company’s robust clinical data and ability to secure substantial capital have contributed to its strong performance in 2024.”

After a quiet summer, the IPO market reached full swing in autumn when Bicara Therapeutics, Zenas BioPharma, and MBX Biosciences all opened on the NASDAQ on the same Friday in September. The ‘triple-header event’ saw the three companies pull in over $700m combined. It was no surprise that the surge in activity came after the Federal Reserve’s decision to lower interest rates for the first time in years, ushering in a more inviting funding environment. This fruitful month was a stark contrast to August, which saw a significant global stock market dip amid fears of a US recession.

In June, Telix Pharmaceuticals – an emerging player in the fast-growing radiopharmaceutical space – pulled a last-minute plug on its IPO. The Australian company had been planning to list on NASDAQ and was on course to raise $232m – a value that would have placed it high on the list of biotech IPO sizes this year. Telix cited that its board did not move forward with the plans due to market conditions at the time.

On The Ground International assists Venezuelan caminantes (pictured) between Pamplona and La Laguna, Santander, Colombia. Credit: On The Ground International / Facebook

The Smart Clinic in La Guajira, Colombia. Credit: Siemens Healthineers

Numb feet, bleeding legs and dehydrated bodies mark their journeys – not to mention infectious diseases and psychological trauma. Studies have identified outbreaks of measles, diphtheria and malaria across Venezuela, while tuberculosis, typhoid and HIV, are also resurgent.

Caption. Credit:

Once we see where those changes are, we can plan where we’re going to cut the bone.

Dr Lattanza

Phillip Day. Credit: Scotgold Resources

Total annual production

Australia could be one of the main beneficiaries of this dramatic increase in demand, where private companies and local governments alike are eager to expand the country’s nascent rare earths production. In 2021, Australia produced the fourth-most rare earths in the world. It’s total annual production of 19,958 tonnes remains significantly less than the mammoth 152,407 tonnes produced by China, but a dramatic improvement over the 1,995 tonnes produced domestically in 2011.

The dominance of China in the rare earths space has also encouraged other countries, notably the US, to look further afield for rare earth deposits to diversify their supply of the increasingly vital minerals. With the US eager to ringfence rare earth production within its allies as part of the Inflation Reduction Act, including potentially allowing the Department of Defense to invest in Australian rare earths, there could be an unexpected windfall for Australian rare earths producers.